Lots Of Different Offers For The US Airways MasterCard

US Airways plays an integral part in pretty much every mileage strategy. I can’t say I’ve ever had a overwhelmingly positive experience on a US Airways flight. Their fleet isn’t really something to write home about. Their international network isn’t something to write home about.

But, they are a member of the Star Alliance. That means you have access to United Airlines flights in the US and carriers like Lufthansa in Europe where you can redeem those miles for great seats to awesome places. And, they’re miles are usually very cheap to acquire. We used to have the Grand Slam, which I’m fairly certain is dead now.

We still have the US Airways World MasterCard. And a whole bunch of different offers for it. There are tons of reports of people holding more than one of these cards at a time and earning a sign-up bonus on each one.

Until yesterday, I was aware of two offers. First, you have the “publicly available offer“, as outlined below:

40,000 Dividend Miles after your first purchase

2 $99 companion tickets

1 US Airways Club day pass

Double miles on all US Airways purchases

$89 annual fee

UPDATE: If you have applied for the publicly available offer (or do so in the future) it appears from one of my readers that you may be able to call Barclays and successfully ask them to waive the annual fee for the first year.

You can also earn 10,000 miles for a balance transfer, but there’s a 3% fee associated with it. And, even though it offers a 0% interest rate for 15 months on the transferred balance, carrying a balance is not a wise decision if you’re going to apply for a bunch of credit cards.

Then, there’s the “Chairman offer“. It’s essentially the same offer as above except the annual fee is waived. It’s supposed to be for Chairman Preferred members of the Dividend Miles program, but there are plenty of successful reports of people without that status using this link and getting the first year free.

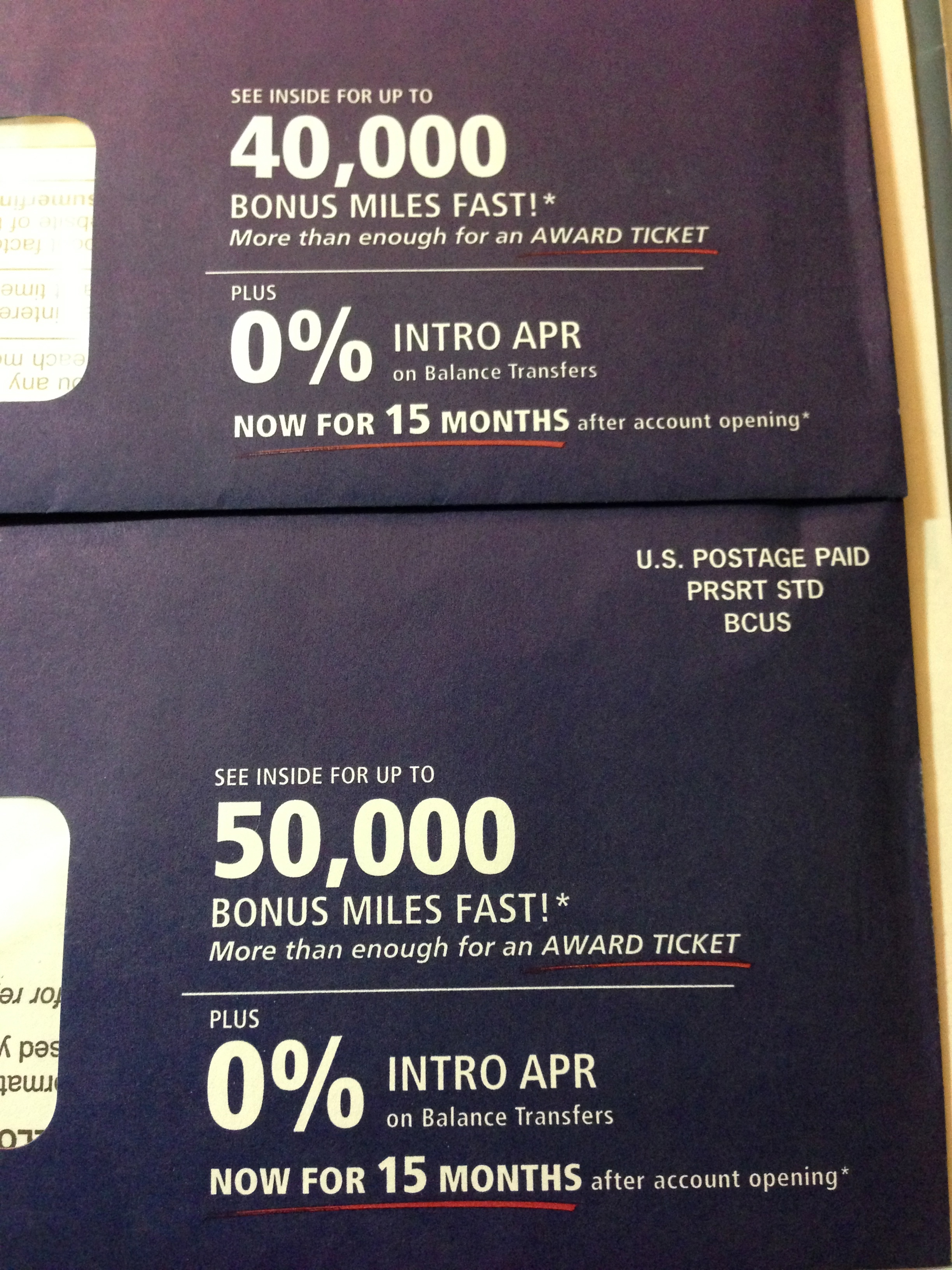

But, apparently these two offers aren’t the only ones out there. In the same day, my wife and I both received offers from US Airways for this card in the mail:

A bit of history. I’ve had a US Airways Dividend Miles account for a couple of years, pretty much solely for the Grand Slam promotion they used to have on a yearly basis. I have a decent balance in that account but I don’t openly look for opportunities to accrue Dividend Miles unless it’s a sick deal. My wife has had an account since earlier in the year when I started getting ready to complete the Grand Slam promo for her as well this year. So, she’s never had any transactions in her US Airways account.

Of the two offers above, she actually got the greater one, which is the same as the publicly available offer I note up top. I got the “lighter” offer of the two, with only 30,000 miles after first purchase (and another 10K if I decided I wanted to do a balance transfer). Both offers came with an annual fee of $89, not waived for the first year.

The only reason I can see for the two different offers for people in the same household would be that the issuing bank may think offering someone who’s never applied for the card before (my wife never has) more miles would give her greater incentive to apply. There is a disclaimer in the T&C that says if you’ve applied for the card before you may not be eligible for it again, but in practice many people continue to apply for, and receive this card more than once.

I do receive a referral credit for the publicly available offer up above. Since it’s a fairly new offer there’s not a lot of people who have received the card to verify they were charged an annual fee on their first statement. For those that don’t have an issue with using a link they don’t technically qualify for, the Chairman offer is the better choice since you could at least print a screen shot of the annual fee waiver and complain if you got charged.

I signed up before the holidays and made my first purchase the other day, but the bonus hasn’t posted yet.

Is this your first US Airways card?

Regards, Edward Pizzarello

Sent from my iPhone

I just signed up via your link for the “Chairman offer” and was offered 60,000 miles, plus all of the other perks you outlined! Woo hoo!

60,000? Haven’t seen that offer yet. How’s it broken down?

Regards, Edward Pizzarello

Sent from my iPhone

Are the ones you got in the mail from Barclays? I’d love to get another bonus giving US Airways card from another bank. I only got the MC this past November from Barclays, so I doubt I can get another one from them this soon.

Any other tips on getting US Airways miles would be much appreciated! I am signed up for their dining club and give the dividend miles number whenever I have the possibility. But any ways to transfer from other program to US Airways would be great to know. Thanks and have a good Sunday!

Elaine, they are Barclay’s. While Barclay is inconsistent in it’s approvals, 3 months is probably too short a window. If it were me, I’d wait until 5 or 6 months.

Regards, Edward Pizzarello

Sent from my iPhone

Yeah, I think so too. Thanks!

Thanks for the heads-up. Going to use your Chairman’s link.

This seems like a really good deal for people traveling out of the U.S. – who would you recommend for travel within the continental United States? In all honesty, Delta and AA seem to ply the most out of my airport, do you know of any good deals for them?

What type of card are you looking for? I currently hold the AA Executive card, which comes with lounge access and the ability to earn 10K EQMs a year. Are you looking for a card that has benefits or earns the most miles?

Regards, Edward Pizzarello

Yes, I would like to have a single card that I use the most and earn the very most miles for travel. Or maybe two cards if there was one that earned maximum hotel nights (U.S. hotels).

I’m new to this game & just signed up for the public offer a couple of weeks ago. I didn’t realize that there’s an existing offer that has the first annual fee waived so I called 2 days ago and received a credit for $89 this morning. It seems like I’ll still receive the lounge pass & companion certificate though so keeping my fingers crossed.

Carlo, do you have any status with US Airways? Was it easy to get them to waive the annual fee?

Regards, Edward Pizzarello

Hey Ed, no status at all. First Barclays application ever. I took a shot at having it waived. First guy I talked to didn’t wanna do anything so I asked for a manager and explained to the latter that I found out about the waived first year offers. He immediately said that he will place an $89 credit and that it should be good in 2 business days. I never had any customer service with Barclays so I was really surprised that it only took about 5 minutes to get someone to waive the fee.

Wow, great report. Thanks, Carlo.

Regards, Edward Pizzarello

Sent from my iPhone

Carlo, I did the same thing – got the public offer not knowing about the chairman’s offer. But I was uneasy about calling because the 40,000 miles was contingent on paying the fee. Who did you call? And did they confirm the miles would still be granted? Did they ask you if you have chairman’s status? I hate paying the fee but did not want to compromise getting the miles, which still have not been credited to my account. Thanks for any advice!

Elaine, I was very specific about saying to the manager that somebody else is getting 40,000 Dividend Miles for paying $0 while I ‘m getting it for $89, which I thought was unfair. However, I should probably call just to make sure that I still get the miles.

Thanks, Carlo. That’s really helpful. If you learn anything else, please post it. I will too. Ever since I realized I did not use the better offer I have been agonizing about it so I was particularly interested when you posted. I am trying to decide whether to call too. It does sound like you still have the miles. Thanks again.

Hey Elaine (and Ed), I just called customer service to verify and yes, I still get 40,000 miles. The rep told me that it’s now contingent on the first $89 in card purchases. Basically, they turned it into an $89 spend requirement for 40,000 miles. Just in case, I got the rep’s ID for reference just in case this falls through. Hope this helps you guys & the rest of the readers.

Hey, thanks so much Carlo. I will call tomorrow!! Thanks again!

Is this a good offer if the routes don’t really work for me right now

…just in case of the AA merger downline?

JWB, the reason why this is a good offer for most travelers is the alignment with Star Alliance and being able to use these miles on most United, Lufthansa or other Star Alliance partners. The same should hold true with oneworld if they merge with American.

Regards, Edward Pizzarello

Well, I often see YMMV as in “your mileage may vary” on various blogs and that sure is true. I called to see if I could get US Airways to forgive the fee, as they did for Carlo, and despite speaking to a supervisor, they would not. When I said I was aware it had happened for another customer in the same situation, first they said no, supervisors can’t do that, and then they said that it was account specific. The supervisor was in the Philippines. Not sure if they have less ability to bend the rules than folks in the US…. Or maybe I was unwise to call at 9PM PST and should have waited til tomorrow.

I asked about whether I could call back and speak to someone tomorrow and the supervisor assured me I could and that she would be sure to notate the account for why I planned to call! Great! Just what I did not need. So it does not look promising.

However, when I opened my account, we also opened one for my husband. This call was re: my husband’s account. In fact, the reason I called tonight was because he was home and could give permission for me to handle it (it is my new hobby, after all, not his!). So I think what I may do is call tomorrow about my account and see what they say. If they agree, I can then ask that they make the same allowance for him.

I’ll let you know what happens.

Elaine, keep us posted.

Regards, Edward Pizzarello

Sorry to hear that, Elaine. This is my first card application at Barclays so maybe that’s why they were a bit lenient (not sure if this is your first application as well). I’m pretty sure I also was talking guys in the Philippines so that probably wasn’t the reason. Maybe they’re reading this blog ??? :0

Thanks Carlo. It is our first experience with Barclays too. Maybe they saw that we just charged the minimum needed to get the miles – only used the card twice since we got it about 5 weeks ago – and that we might not be the best customers for them. $89 for 40,000 miles is still a good deal. You win some, you lose some!

Carlo, let’s hope they’re not reading. They might not let people get multiple bonuses anymore. :O

Regards, Edward Pizzarello

I don’t think I would try getting any card issued by Barclays anymore. I tried getting the US Air card but the rep on the reconsideration line would not budge. Said “too many new accounts” 🙁

MCP, you might try the reconsideration line again. People report widely different behavior by different agents on that line.

Regards, Edward Pizzarello

Sent from my iPhone

Good news! In fact, better than good! $180 worth of good. I called again this morning, this time starting with my own US Airways card. The account rep transferred me to an account specialist, who was more than happy to refund the fee, assuring me I would keep every last benefit this account offered. I brought up the issue of my husband’s account, and once he gave the rep permission to talk to me – luckily he was late in leaving today and was still home – the rep promptly did the same for him! Score!

I asked the rep what department he was in – turns out he was a retention specialist. Clearly they have a lot more authority than the supervisors of the ordinary account reps. I think frm now on I will ask for a retention specialist, not a supervisor!

So, I am thrilled and so grateful that 1) Ed brought up the topic and 2) Carlo posted about his experience. Thanks, guys!

And there’s more: As part of my plan to start accumulating points, I also opened an AMEX Hilton Honors acct., which had a $750 spend to get 40,000 points. To my surprise, 3 weeks later my adult son received a snail mail offer for 60,000 points for the very same $750 spend. Everything else matched exactly too. So figuring I was on a roll, I called about that.

My call the HH was useless – it’s an AMEX issue, they said, which I knew, but I also thought they could just give the points to keep me happy if they chose to. But no. They connected me to AMEX, who claimed she could do nothing, But she did transfer me to the line that specifically handles HH/AMEX. And after first telling me that different offers come at different times and my sons’s letter was totally random (which I doubt – he had 790 points in HH and had not posted anything in almost a year) he said that since I sounded unhappy, he’d ask his supervisor if he could give me 10,000 points. I said OK but that it would still leave me 10,000 short – but to do what he could. He laughed, put me on hold, and came back in seconds with the good news that he was posting 20,000 points in my account! Can I say SCORE?!

Ed, I’ve become a regular reader. You can be sure I will remain one! Thanks again and a good week to all!