One Of The Best Values In Travel Is Adding Three New Transfer Partners

I earn affiliate credit if you sign up for the Bilt Rewards Mastercard using links in this story.

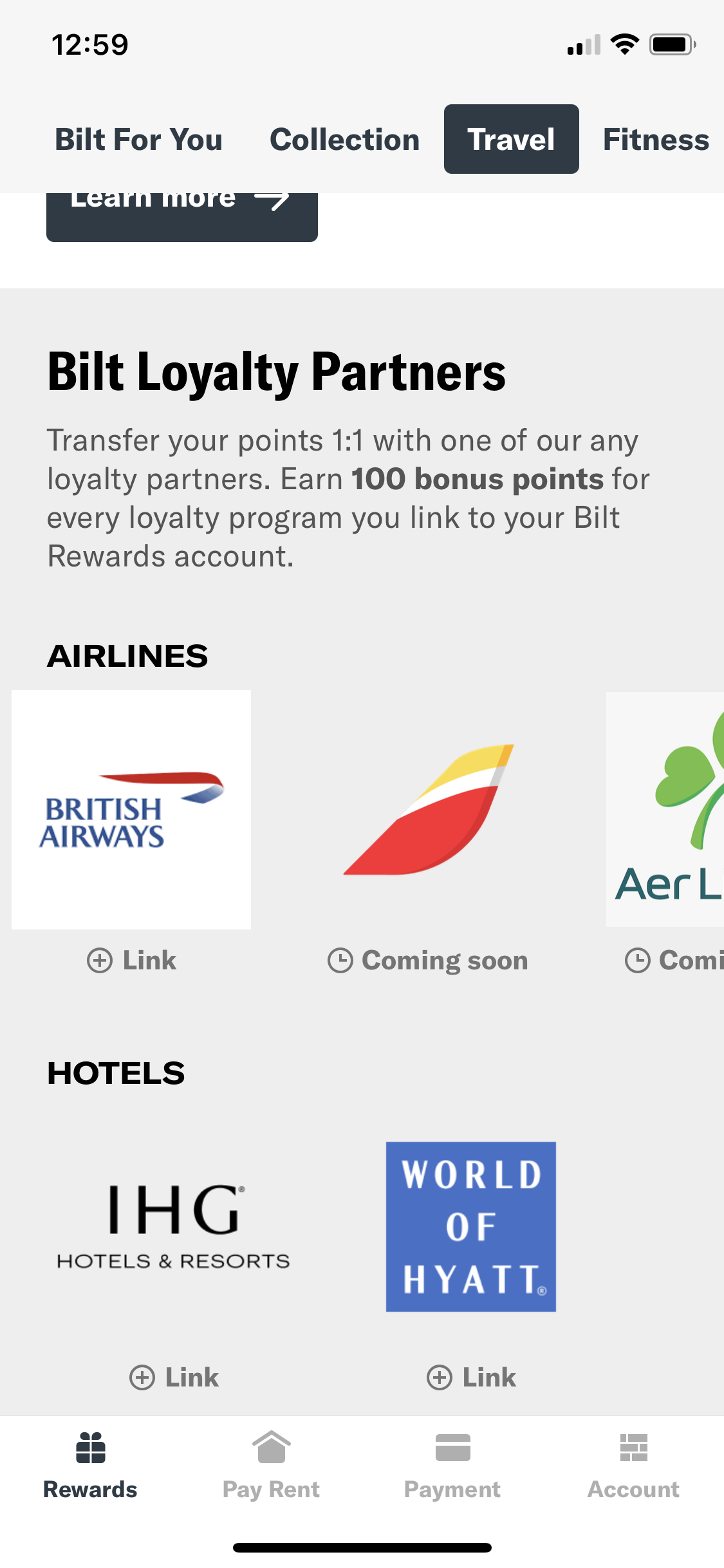

Bilt Rewards, one of the most valuable flexible currencies in travel, is adding three new transfer partners to an already healthy list of travel brands you already know. Today, they launched 1:1 transfers to British Airways and announced they would be adding Iberia and Aer Lingus shortly. With these additions, here’s the full list of travel partners you can transfer Bilt Rewards points to:

- American Airlines AAdvantage

- Air Canada Aeroplan

- United Airlines MileagePlus

- Emirates Skywards

- Air France/KLM Flying Blue

- Hawaiian Airlines HawaiianMiles

- Turkish Airlines Miles & Smiles

- Virgin Atlantic Flying Club

- Cathay Pacific Asia Miles

- British Airways Avios

- Iberia Air Avios

- Aer Lingus Avios

- World of Hyatt

- IHG One Rewards

Bilt Rewards offers 100 points for each of these programs, but they have offered larger bonuses in the past. Unless you have an immediate need to transfer your Bilt Rewards to British Airways it may be worth waiting a bit to see if they offer a bigger bonus.

You don’t need to sign up for the Bilt Rewards Mastercard to earn points in the Bilt Rewards loyalty program. In fact, one of the best values of the Bilt program is for renters who can earn up to 50,000 points a year by paying your rent through Bilt.

The Final Two Pennies

I do think the Bilt Rewards Mastercard is an exceptional value. Folks who have followed me over the years know that I don’t spend a bunch of time hawking credit cards no matter how good they are. I took some flak for asking whether Bilt Rewards is the most valuable currency out there. I love the fact that the Bilt card has no annual fee but still comes with “big boy” benefits like the Chase Sapphire Preferred. Every time they add another travel partner it becomes harder to ignore the network they’ve built. Two points on travel and three points on dining make this a great card to earn points on.

When folks who are just starting to figure out the points and miles game I ask them if they have a 401K plan or a similar retirement plan. Most folks reply that they do. My follow-up question to them is whether they invest their entire retirement savings in one stock. That answer is always no (thankfully). The logical extension of that is that most people are better off holding some sort of flexible currency (such as Bilt Rewards, Chase Ultimate Rewards or American Express Membership Rewards) rather than holding a big balance of one airline or hotel company’s points.

That’s where Bilt Rewards fits in. Earn valuable points while keeping your options open until you’re ready to plan your next trip.

Did you enjoy this post? Please share it! There’s plenty of ways to do that below.

You can also follow me on Twitter, Facebook and Instagram.

And, I hope you’ll check out my podcast, Miles To Go. We cover the latest travel news, tips and tricks every week so you can save money while you travel better. From Disney to Dubai, San Francisco to Sydney, American Airlines to WestJet, we’ve got you covered!

Bilt is absolute garbage. I actually agree that 3x points on rent and restaurants is compelling. I also think think that Bilt rewards is probably the most valuable points currency (due to the unique combination of AA and Hyatt). However, it is a bit illusory because Bilt/WF will close your account and shut you down if you actually take advantage of these bonus categories. Also worth asking: is the Bilt MC the worst credit card for non-bonused spend, since they offer less than 1x per dollar? Odd that this question is not squarely addressed in any mainstream blog posts. Suggest avoiding this start-up amateur act.

Stephen, not sure why/if your account got shut down but happy to put you in touch with someone to try and figure out why. Also, the card earns 1X on rent, not 3.