Marriott Is Selling Gift Cards For 20% Off. Should You Buy?

I know, I know. If you love travel even just a little bit, you’re saying, “Ed, is this a trick question?” “Marriott is selling gift cards for 20% off. Of course we’re buying.” I think it’s a legitimate question. Before you bit my head off, let’s cover the basics.

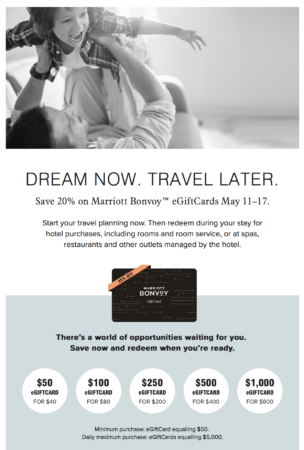

Marriott Is Selling Gift Cards For 20% Off

Marriott announced this deal a few days ago and I’ve just been swamped, but really wanted to write about it. It’s pretty straightforward.

This matches the best deal I’ve ever seen offered on Marriott gift cards. It’s the same deal offered during Daily Getaways. More on that in a bit. It’s also important to note that Marriott, like most hotel companies, has really flexible cancellation policies right now. You can go so far as to book a prepaid rate and still cancel for a full refund within 24 hours of arrival (currently until the end of June, though I wouldn’t be surprised to see this extended.

Should You Buy Discounted Marriott Gift Cards?

I’m honestly a bit torn. This is really widely available right now, which does give me a small bit of pause. For perspective, Marriott made a grand total of $262,500 in gift cards available during last year’s Daily Getaways. I have it recorded on my post from last year. They sold out in a heartbeat. Here, the daily limit is $5,000. That means someone could buy $35,000 in gift cards. One person could buy more than 10% of what they made available for Daily Getaways. Translation: Marriott is really hoping you buy.

Before you purchase (especially if you’re considering a big purchase) consider how long it will be before you use the gift card funds. Remember that prices may be severely depressed for quite some time. Holding onto a gift card in your desk drawer won’t earn you any interest on that money. You’re unlikely to earn a 20% return on cash anywhere in the next 6 months (if you know a guaranteed way, let me know) so the 20% discount is still likely very profitable if you know you can travel and burn up whatever gift cards. But, there is some price associated with parking cash in gift cards.

And, if you’re a business traveler, consider that Marriott may try to earn your business back with lucrative promotions involving lots of bonus points. The more points you have, the less you need to buy discounted gift cards.

I hesitate to use words like “always” and “never”, especially after seeing things like negative interest rates during the Great Recession and people willing to give away a barrel of oil for free a few weeks ago. However, I think it’s also worth noting that I can’t really conceive of any scenario where Marriott disappears as a company.That means buying a Marriott gift card likely carries little risk.

The Final Two Pennies

If you’re not a business traveler who anticipates getting back on the road this year, then these gift cards are probably a great way to save money on your next vacation. I’d caution you about investing too deeply in this. Even though I’ve made a run at the Daily Getaways deals in the past, I’m not sure how much I’ll be buying here. I can save money on business travel, but it’s only worth it to me for travel I anticipate this year.

I do believe there are likely to be similar deals from other travel companies, possibly even better. Marriott isn’t my first choice for hotel brands, that’s Hyatt. If Marriott is your first choice, you probably want to consider a purchase here. If they’re not, just think carefully about how you’ll use the gift cards before plunking down cash in an economy with some serious headwinds. Awful hard to buy groceries for your family with a Marriott gift card.

Are you buying Marriott gift cards?

Did you enjoy this post? Please share it! There’s plenty of ways to do that below.

You can also follow me on Twitter, Facebook and Instagram.

And, I hope you’ll check out my podcast, Miles To Go. We cover the latest travel news, tips and tricks every week so you can save money while you travel better. From Disney to Dubai, San Francisco to Sydney, American Airlines to WestJet, we’ve got you covered!

It’s $5,000/day PER CREDIT CARD, so you can really rack it up the gift cards if you are so inclined.

Um, wow.

Was there any relevance to “Remember that prices may be severely depressed for quite some time”? You’ll get the same severely depressed rates when using the gift cards – correct?

Regarding “The more points you have, the less you need to buy discounted gift cards.” With depressed rates isn’t spending points, or using certificates, a poorer value than usual? Or are they likely to declare more off-peak point pricing while the rates are low?

And if Marriott comes up with some big promos, paying with cash or gift cards becomes an even better value over

using points and certificates.

Carl,

The note on depressed pricing was a point in favor of travel in general, and that investing in gift cards could make already cheap travel even better.

With paid rates low, it might make sense to pay cash instead of points in a vacuum. But, I think I would say two things in regards to that. First, we’re not in a vacuum. Cash is king and I’d be thinking about burning points at a lower return right now so you can hold more cash. That may not be the right strategy for everyone, but it will be for some. Second, keep in mind Marriott hasn’t been shy about raising award rates. A big stash of points probably won’t be worth more later.

I do think the promos will help inform which direction customers should choose (cash or points). That being said, business travelers with a big bucket of points should still be burning. 🙂

Makes sense, I remember when Club Carlson (now Radisson) would offer so many stacked promotions that it often made using points look like a poor decision (especially on one night stays). Sometimes you could stay one cash night and earn enough for a free night plus. Then use points on multi-nights stays, especially when they had the last night free.So one cash night could end up as two free nights,

Ed – aren’t you ignoring two aspects? First, you can’t use these against pre-paid rates. Secondly, it seems the cards must be charged in US$ and, overseas, hotels have carte blanche to decide what FX rate they use when deciding how much to deduct from your girst card.

Rob, I do think you can use these on prepaid rates, but YMMV. I’ve frequently had properties be willing to swap out payment methods upon arrival at the property.

I wasn’t aware they would be charged in US$ overseas but that makes sense. And, yes, I’m sure the FX rate won’t be overly favorable. Good point.

To the author, what do you think the risk of Marriott going bankrupt is?

Ed,

what do you figure this means?

“eGiftCard Delivery Date should not exceed 3 months from date of order.”

Given that the line above says that you should receive your GC within 7 days, the above almost reads as “the GC has to be used with 3 months”, but that makes no sense to me.

WIth a lot of gift cards you can delay the delivery (like until somebody’s birthday). This would override the 7 days.

I think this is referring to that.