Why I Got The American Express (Rose) Gold Card. And, Why I Think It’s A Great Card For Families!

I probably don’t talk enough about credit cards on this blog. I guess I’ve always felt like other bloggers cover that area very well. And, since I’ve avoided credit card affiliate links for the most part on my blog I’ve never felt the pressure to write about specific credit cards. The reality is that most points and miles are earned through credit card spending. That’s definitely the case for me.

A few months ago my good friend Tiffany from One Mile at a Time hopped on my podcast with me to tell me I needed to re-work my wallet. She was absolutely right. And, in true Ed Pizza way too busy fashion, I gave that advice to everyone and didn’t follow it. Then, about a month ago I wised up and applied for the American Express Gold Card.

Why American Express Gold Is Good For Families

American Express was the very first credit card I carried in my wallet. A green charge card from back in 1994 was my first, and I’ve had plenty over the years. But, I stepped away from the Membership Rewards program for a decade or two while I focused on the SPG AMEX. The value for those cards has changed dramatically. It seemed like a good time to make sure I had another card that earned flexible points in my wallet.

The reason why I chose the American Express Gold Card (and why most families should think about getting it) was for the newly revamped bonus categories. Don’t get me wrong, being able to get a swanky rose gold colored card for my wife was part of the attraction.

But, the new bonus categories really do fit a family well:

- 4 points per dollar at restaurants.

- 4 points per dollar at grocery stores.

- 3 points per dollar on travel.

- $120 in credit per year at participating restaurants.

- $100 airline fee credit per year.

If you’re thinking about signing up for the card, make sure you grab a referral offer from a friend. The standard sign-up bonus is only 25,000 points, where the referral offer is 50,000 points. Here’s my referral link if you need one to sign up. And, if you already have the card, feel free to add your link in the comments. Note: please only add your link once to be fair to others.

Other Benefits

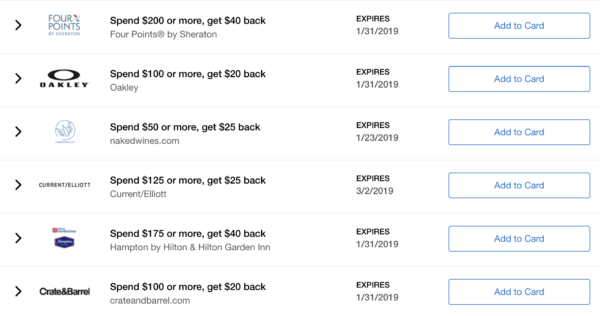

The American Express Gold Card also comes with other useful benefits, such as car rental insurance, extended warranties and a free Shoprunner membership. There are other cards that outweigh the AMEX Gold card here, but the benefits are decent. And, AMEX Offers can add a bunch of cash to your wallet over the course of the year. These are semi-targeted offers for brands you know and probably already spend money with. Here’s a snapshot of offers on my account right now:

I have a total of 87 offers in my account right now. These can make a big dent in the $250 annual fee.

Finally, the AMEX Gold card earns Membership Rewards points, which can be transferred to a number of airlines and hotel partners. This gives you the flexibility to use points in the way that makes the most sense for you.

The Final Two Pennies

I probably need to talk more about credit cards here. They really are the best way for many families to earn the miles and points necessary to travel without breaking the bank. The reason why I think this card represents a great value for families is because I have a family, too. And, we spend a bunch on restaurants and groceries. We try not to spend a bunch on travel because we earn points wherever we can. The typical family will get a lot of mileage out of this card. And, using the card the right way makes the $250 fee disappear.

The rose gold card is only available for a few more days, for folks who apply and are approved by January 9, 2019. I have no idea if the 50,000 point sign-up offer goes away then. We’ll find out soon.

I’ll leave you with one more thought. Since I don’t write about credit cards a lot, this may be the most important part. It’s only the right decision to apply for cards like this if you can afford to pay off your balances every month. Paying 10 or 20% interest on credit card debt far outweighs the value you get from points. So, if you’re thinking about heeding my advice on adding a new card to your wallet, make sure you heed this advice first. Use credit wisely and it’ll reward you handsomely. Use it poorly and it will cause trouble.

Did you enjoy this post? Please share it! There’s plenty of ways to do that below.

You can also follow me on Twitter, Facebook and Instagram.

And, I hope you’ll check out my podcast, Miles To Go. We cover the latest travel news, tips and tricks every week so you can save money while you travel better. From Disney to Dubai, San Francisco to Sydney, American Airlines to WestJet, we’ve got you covered!

Isn’t this a charge card so you do have to pay the balance in full each month? Or does Amex give new card members the option to pay over time? BTW, kudos on being an Amex card member since 1994! Wow!

You NEVER want to carry a balance on either a credit card or a charge card. Interest rates are usually crazy high.

The way to succeed at the points game is to pay in full and remember that slow and steady wins.

Amen, Deb.

Joey, long-time card member! It is a charge card but AMEX has some bolt-on pay over time options for certain purchases.

Does AE have a limit of 4 credit cards per account?

Zoe, I believe it’s 5. I currently have 5.

I have 5 Amex cards and am AU on another one. My oldest credit card is Amex — 1984! No AF and will never get rid of it!

Deb’s link: https://mgmee.americanexpress.com/refer/us/en/4E64645C3A66FF23EE23A2189EAA4905E2A181B4F4907C6A3AD8900CBF5BDBCD42F5FB1476008E144691E769D0F60E9053F4B6992AA1DCC1E8561CF37A73EF7422F7749EE1EBF29279EDD48551A86861BEA42553B29591751B20BD4F76026AF893798DF29C855CC7B0DD356CFFB64CE7/?GENCODE=349992592898658&extlink=US-mgm-seo-copypaste-784-200002-GBPC:0001&CPID=200002&CORID=D:E:B:R:A:T:4:r:g:u-1546827802496-1152789231

Just started listening to your podcast, great stuff!

http://refer.amex.us/VINCEGAxfr?XLINK=MYCP

V, thx for the kind words!