Breaking Down The Text of the American Airlines/US Airways Merger Complaint

I posted quickly yesterday some initial thoughts on the lawsuit that the US Department of Justice filed to block the American Airlines/US Airways merger. I spent some more time yesterday and this morning and have a few more things to offer up. I went through the full text of the complaint last night (just over 50 pages) and carved out some items I think represent DOJ’s main thoughts here as well as some items I disagree with. Keep in mind I was never strongly in favor of the merger so it’s not like I’m trying to argue for my favored position. You can find the full text here.

American and US Airways compete directly on thousands of heavily traveled nonstop and connecting routes.

There are lots of ways to make things sound the way you want them to. American and US Airways do compete on lots of connecting routes. And, that number might very well be in the thousands. But, the number of nonstop routes, a point I would argue that was used as a barometer in evaluating past airline mergers, is very small. If the math is still correct, it’s less than 2 dozen.

That enhanced cooperation is unlikely to be significantly disrupted by Southwest and JetBlue, which, while offering important competition on the routes they fly, have less extensive domestic and international route networks than the legacy airlines.

Again, the DOJ wrote portions of this to reflect the point of view they were hoping for. It’s like they made their decision on the things they wanted to object on and then crafted some of the facts to match their assumptions. Here’s a look at Southwest’s domestic map for starters.

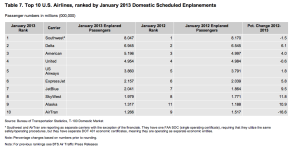

Southwest serves just shy of 100 destinations between its Southwest and AirTran brands. And, they really are the largest domestic carrier, on whole carrying more passengers around the United States than any of the other legacy airlines.

But, sure, when you combine domestic and international traffic, they have a smaller network. The European Union already said they don’t have a problem with the merger because of their belief that a combined entity wouldn’t affect competition in the EU, so I find it hard to believe the DOJ thinks the international portion is the issue here. Domestically, Southwest can and does compete with the legacy airlines in a very significant way. And, JetBlue does a lot to keep them honest as well.

They also cite Doug Parker a number of times saying things like, “Three successful fare increases- [we are ] able to pass along to customers because of consolidation.” Yes, Doug, that may not be the smartest thing to say publicly if you’re hoping to continue to have the DOJ look upon these mergers favorably.

The other legacy airlines take a different approach. If, for example, United offers nonstop service on a route, and Delta and American offer connecting service on that same route, Delta and American typically charge the same price for their connecting service as United charges for its nonstop service.

No. I can cite markets all day long where this isn’t the case. One of the primary routes I travel, Washington-Dulles to Denver is an example. United prices a large portion of the fares on these routes to require a round-trip component. If you’re booking a round-trip between this city pair, they have traditionally still been $100 more than American over the past two years. And, if you try to book a one-way fare, United’s pricing jumps to double that of American. And, no, this isn’t a single example. United does a solid job of pricing their nonstops higher and filling those planes.

If the merger were approved, US Airways’ economic rationale for offering Advantage Fares would likely go away.

It’s hard to refute this, since I have no idea what the thinking on such things would be with a combined airline. But, it does give us a pretty good idea how DOJ is positioning this. They don’t believe a combined airline will need to provide discounts.

Consumers will likely also be harmed by the planned merger because American had a standalone plan to emerge from bankruptcy poised to grow. American planned to expand domestically and internationally, adding service on nearly 115 new routes. To support its plan, American recently made the largest aircraft order in history……American’s standalone plan would have bucked current industry trends toward capacity reduction and less competition.

Seems like I’m doing more debunking than just clarifying the DOJ position. I haven’t seen any list that shows 115 new routes American is considering. And, that largest aircraft order in history is also largely being used to replace an aging fleet of MD-80s, not spin up new service. Sure, the order supports a plan to expand, but for the first time in history, the airline industry has been disciplined about adding capacity. I don’t see that changing anytime soon. And, when you take into account American’s existing domestic network, Southwest’s huge domestic network along with Delta, United and the likes of JetBlue and Virgin, how much more capacity is really needed in the domestic US market?

Passengers to and from the Washington DC area are likely to be particularly hurt.

Easily the most significant concern and truthful statement in the report and I’m not even done reading yet. I don’t believe that passengers in DC will be particularly hurt but US does have a large presence there now. That being said, they have a significantly larger percentage of the traffic at Charlotte (over 80%, iirc) than they do at National (DCA). But, if DOJ has a real concern here I’m sure something similar to their agreement to reduce frequency between Philadelphia and London would work here as well.

The complaint details a predictive index for concentration in a relative market to try and illustrate how the merger will drastically affect customers. The problem is they use the Charlotte-Dallas city pair as their example, claiming that the merged airline will absolutely dominate this city pair. Well, duh. US Airways already controls over 80% of Charlotte flights. And, American is by far the dominant carrier at DFW, their biggest hub. This seems to be one of their big “ah ha!” moments where they show how much damage this would do. Again, just a really unreasonable example to use. That’s like saying the Yankees are anti-competitive because most of the people attending a game at Yankee Stadium wear Yankee apparel.

“Capacity discipline” has meant restraining growth or reducing established service…..In theory, reducing unused capacity can be an efficient decision that allows a firm to reduce its costs, ultimately leading to lower consumer prices. In the airline industry, however, recent experience has shown that capacity discipline has resulted in fewer flights and higher fares.

Yes, and in many other industries as well. That’s just good business. If the oil cartels pump less oil they decrease supply in the face of steady demand. Price goes up. Arguing that some businesses will lower capacity and lower consumer prices is just silly. Businesses are in business to make money, pure and simple. The principle reason for lowering capacity is to save money/increase revenue. Businesses also will lower prices to increase revenue as well. Business 101. I can’t honestly say there are many businesses out there that dream up scenarios where they cut capacity so they can then lower the price they charge consumers.

The airline industry is doing something pretty straight forward here, trying to put the right number of planes in the sky to satisfy demand without having a bunch of empty planes. If a hotel thought it could fill 100 rooms a night, would it make sense to build a hotel with 10,000 rooms?

United and Continental closed their deal on October 1, 2010. The combined firm has reduced capacity at nearly all of its major hubs (including Cleveland) and at many other airports where the two airlines previously competed.

DOJ is trying to make a point here that Cleveland was shrunk only because of the merger between United and Continental. Never mind the fact that all the legacy carriers have been shrinking capacity as specifically outlined one page earlier in the DOJ filing, probably due to the fact that larger networks cost them billions of dollars in losses in the previous decade.

The whole thing is a very interesting read, but wildly inconsistent. The DOJ stakes out conflicting opinions in the document to make points that are in direct contradiction to each other. I can’t say I’ve read a ton of these filings, but this appears to be much more written in “politician speak” than legalese. The report is long on citations of things people said (like Doug Parker, who provides a ton of fodder) and things the DOJ thinks, as opposed to reports that back up their assertions. It’s pretty light on those details.

Here’s the thing. The DOJ is right. This merger will reduce competition. Some customers will pay more. This complaint just does a piss poor job backing up that assertion. Ultimately, I don’t think the merger will specifically reduce competition by a dangerous level. The airlines have shown significant discipline when it comes to restricting capacity over the past couple of years. They’re perfectly capable of abandoning that strategy but I don’t think that’s likely.

Sure, US Airways will continue to offer Advantage Fares that save some customers money. And, United will still charge $500+ for a round-trip ticket to Austin if it can, since it’s the only carrier that offers nonstop service on that route.

As I said yesterday, I still think there’s another chapter to be written before this merger is officially dead. And, I think the DOJ has overplayed its hand a bit here. Can Humpty Dumpty be put back together again on this merger? Yes, but DOJ is going to need to back down and not look like a pushover when doing so. That means American and US Airways are going to have to play nice, though I’m not sure specifically what that means in this situation.

We may still end up where we expected, but it’s sure an odd way to get there.

I have some other thoughts on the overall affect of these developments, but this post has gotten kind of long, so I’ll save those thoughts for later.

One Comment