Massive Delta Changes To SkyMiles And Sky Club Access: Decision Time

Maybe you heard? Delta made some massive changes to their loyalty program and how travelers will access Sky Clubs in 2024 and beyond. If you already heard about that, skip down to my analysis of the changes and share your thoughts in the comments. If this is the first you’re hearing about the changes, grab a seat and a snack. We’ve got some ground to cover.

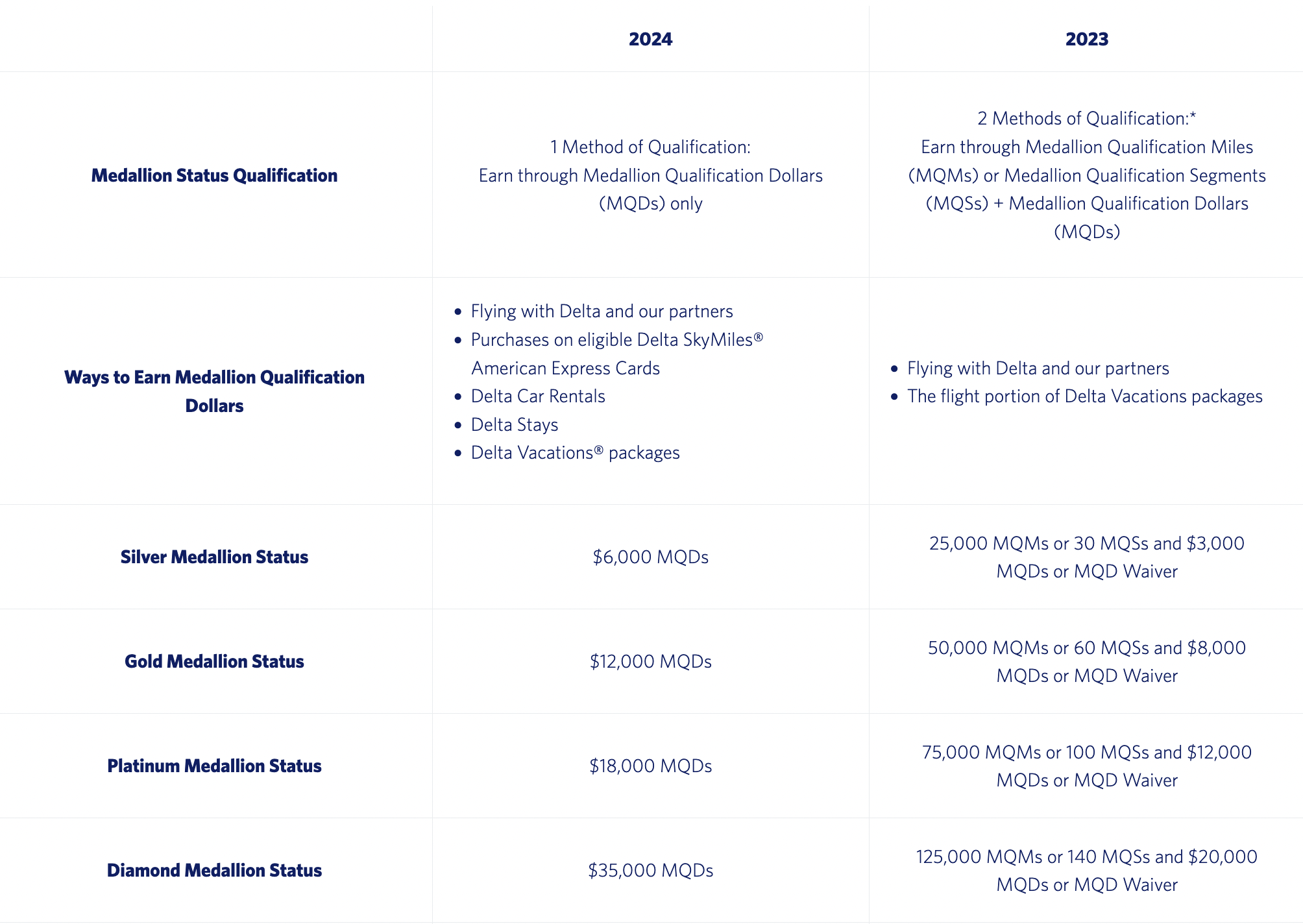

Delta SkyMiles Elite Status Changes

Delta is simplifying how you earn elite status while also making it much more difficult. Instead of tracking how many miles or segments you fly with Delta they only care about one metric going forward, how much you spend. While the new structure is simplified, it’s going to be much more difficult for many frequent travelers to earn status with Delta going forward. As you can see from the chart below, the spending required to obtain elite status has increased by 75%-100% from the current levels to the new levels.

Delta has also done away with the Medallion Qualification Dollars (MQD) waiver completely. While a Delta credit card can help you achieve elite status the earning structure on credit cards going forward is much worse. More on that in a moment.

On top of earning MQDs by flying with Delta you can also earn MQDs a few other ways:

- Earn 1 MQD per dollar spent on car rentals booked through Delta.

- Earn 1 MQD per dollar spent on hotel stays booked through Delta.

- Earn 1 MQD per dollar spent on Delta Vacations.

Delta has preserved a path for credit cards to contribute to elite status but only for their two most expensive credit cards:

- Earn 1 MQD for every $20 spent on the Delta Platinum and Platinum Business credit cards.

- Earn 1 MQD for every $10 spent on the Delta Reserve and Reserve Business cards.

My Reaction To SkyMiles Changes

I’ve been a Delta Diamond member for the past few years. They had some lucrative promotions during the pandemic that helped me earn Diamond status by spending on their credit cards. At first, I really enjoyed my experience with Delta. These were pretty much all connecting itineraries, which meant I dealt with Sky Clubs as well as what their hubs were like.

While Atlanta isn’t my favorite, Minneapolis and Detroit are delightful airports to connect through. The clubs were, for the most part, pretty crowded. But, the onboard product was superior in many ways to my experience with United Airlines. For starters, in-flight Wifi was much more reliable on Delta. The onboard service was, for the most part, much better. The catering was as well, along with Delta’s on-time performance.

Since then, Delta has come back to the pack a bit while United has gotten a bit better in most of those areas. I built up a large number of rollover MQMs that would allow me to earn Diamond status for 2024. However, I’d need to put something like another $150,000 on my Delta credit card over the rest of 2023. I’m probably not willing to do that. More on that in a bit.

Asking customers at the lowest elite status level to spend $6,000 on Delta flights (or some combination of flights and other spending) is an awful lot to ask. Asking some of their best customers to spend $35,000 is downright offensive. To do so would require some level of sacrifice for many Delta customers.

For starters, the only bonus category on the premium Delta credit cards is 3 miles per dollar on Delta purchases. That means many customers will leave a lot of earning on the table versus cards that award bonus miles for popular spending such as restaurants, grocery stores or gas stations. Even a standard 2% cash back credit card would likely be worth much more than 1 SkyMile per dollar. As well, booking car rentals and hotels through Delta will mean earning fewer rewards and being stuck earning SkyMiles (which Delta has frequently made less valuable).

Delta Sky Club Access Changes

Delta has had an overcrowding issue in their lounge network for quite some time. Dubbed Sky Clubs, their lounges have, for the most part, been better than their competition at American and United. The food offerings in Delta Sky Clubs have been better for quite a few years and they’ve invested in renovating many of their Sky Clubs.

For many years, Delta has offered Sky Club access to the holders of a number of different credit cards. American Express Platinum and Business Platinum Card holders have enjoyed unlimited access (more recently that changed to only when flying with Delta). As well, Delta’s own premium credit cards, the Reserve/Business Reserve and Platinum/Business Platinum earn unlimited Sky Club access when traveling on Delta flights (except for basic economy fares). Going forward, these access levels change drastically:

- American Express Platinum/Business Platinum Cards: Six visits per year

- Delta Reserve/Reserve Business Cards: 10 visits per year

- Delta Platinum/Platinum Business Cards: no access

A “visit” is a single entry into a Sky Club. That means if you showed up at JFK for a flight to Montana that connected in Salt Lake City and visited the lounge in JFK as well as in Salt Lake City during your layover, you’d use two visits in one trip.

My Sky Club Access Reactions

I am honestly surprised at how far Delta went in curbing access to Sky Clubs. They have been masterful at convincing customers to apply for cards with high annual fees (as high as $550 per year). By creating meaningful benefits for spending (MQD waivers) they convinced customers to spend on credit cards that were less rewarding than many other credit cards. They also convinced customers that they would have Sky Club access to make their travel better.

Now, both of those rewards are either gone or severely diminished. A Delta Reserve cardholder could burn through 10 Sky Club visits in the first couple of months of the year and be shut out from club access for 10 months. That same Delta Reserve cardholder would need to spend $350,000 on the Reserve card to earn Diamond status. Even with a combination of paid travel on Delta and credit card spending, a Reserve cardholder could be looking at putting $100K or more on a card that doesn’t earn them near the best value for that spending.

The Final Two Pennies

The announced Delta changes are quite severe. It’s worth noting the airline has said they’re not done announcing changes, though it will likely be 2024 before we hear more on that front. There’s no doubt these changes will make a significant difference in my travel choices for 2024 and beyond. Some of those changes will start immediately.

I currently hold two Delta Reserve credit cards. I’ll think about this for a few more days but I’m pretty sure I’m canceling one immediately. One of the reasons I was holding onto those cards was the ability to earn MQMs towards lifetime status on Delta. Going forward that part of the program is being eliminated. Since I’m only halfway to my first million miles on Delta there’s really no reason to continue. That means dumping one card immediately is likely the right move.

I could hold onto the other Reserve card and finish spending $250K this year on it to earn Diamond status again for 2024. I’m sure it would come in handy a handful of times over the course of the year. That would also mean committing at least another $100K in spending on a card that I know isn’t as valuable as it could be elsewhere. That may be a hard pill to swallow.

If I cancel both cards now/soon then I won’t try for Diamond next year, and my Delta experiment is likely over.

Everyone else will need to make their own decisions about whether it’s worth it to patronize Delta at the same level going forward as they do now. It’s easy to say, “I’m hub captive. I live in Atlanta. What else should I do?”

I really do think most folks have options. Heck, my podcast co-host lives in Atlanta and rarely flies Delta even though he’s on the road more weeks than not. Whether you’re better off as a complete free agent or jumping to another airline is hard to say. But, with changes this drastic, all your options should be on the table.

Did you enjoy this post? Please share it! There’s plenty of ways to do that below.

You can also follow me on Twitter, Facebook and Instagram.

And, I hope you’ll check out my podcast, Miles To Go. We cover the latest travel news, tips and tricks every week so you can save money while you travel better. From Disney to Dubai, San Francisco to Sydney, American Airlines to WestJet, we’ve got you covered!

Delta is like CrossFit. A legal cult that seeks to separate people from reality and their hard earned money

Matthew, this literally made me laugh out loud.

FYI I think subsequent SkyClub visits within 3 hours are considered the same. But I agree it’s overkill.

I’m also disappointed about the removal of boosts and the fact that the Delta Platinum earns half as many MQD now…. even if I have a Reserve. Screw the bonus categories, I guess?

I am like you — I have three Delta cards atm. I will eliminate two of them, which is fewer AF revenue for somebody. TBD on how much I’ll use the other one.

Miles, I’ll try to get an answer from Delta on subsequent visits. At this point, I’m pretty sure I’m killing both Delta cards. What DL card do you plan on keeping and why?

Great, thoughtful article. Totally agree. I’m surprised you’re on the fence about the second reserve card. Why wouldn’t you swap it even for, say, an Amex Green card and an Amex Biz Blue+. Then you’re earning 3 miles on all travel (not just flights), 2 on all biz spend etc. And doing it in a reward currency that is so much more valuable than Skypesos given redemption options for IB, Turkish, AF, and even Virgin (e.g., for use on domestic Delta itineraries). Or Amex Platinum, earning 5x on all flights, prebooked hotels etc., spend $75k then you get unlimited Skyclub access anyway, and with a bit of planning, you likely get the annual fee back anyway given the credits. Plus on Green and Platinum, you can likely get bonuses for opening the accounts of 60k and over 100k respectively.

khatl, all your reasons are sound. I just wanted some time to think through the details before committing. But, as I discussed on the podcast this week, I’ll be getting rid of both cards.