It’s been an interesting few weeks to follow the DOJ intervention into the merger between American Airlines and US Airways. I’ll admit to being surprised when maybe I shouldn’t have with DOJ weighing in. But, I don’t think I’m in the wrong when I say that DOJ has been a bit sloppy here and there with their prose so far. I don’t necessarily think their position that a merger is anti-competitive is “wrong”, but I do think they could have positioned their arguments better so far. And, as a consumer, I think I’m still in favor of an independent American versus a merged entity.

Recently, DOJ announced their desire for a trial date in February. AMR/US countered (appropriately, IMO), that the timeframe was too long and cited recent DOJ and FTC merger trials as their foundation for a 90 day request. The trial judge noted that she had a trial on her docket that would likely interfere with DOJ’s preferred dates and asked both parties for feedback.

As noted by

View From The Wing, the DOJ decided to push their date further back to March to accommodate the judge’s trial schedule. I didn’t expect them to move it up to January, but I also didn’t expect them to continue to refer to the schedule as reasonable and timely when they were suggesting

more time than their original request. See the

full response here.

Well, American and US Airways responded yesterday. I’ve snipped a few chunks of the response for comment below. DOJ language is in quotes and bolded black, airline’s answers in italics below:

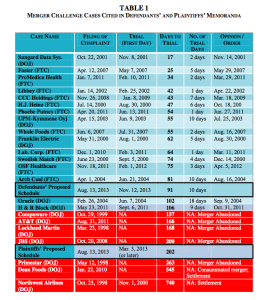

“Six months to a full trial on the merits is in keeping with timetables in comparable merger cases.” (Opp’n at 8.) As the table below demonstrates, of the 23 cases cited by the parties, only 3 had trial schedules as long as plaintiffs’ request, whereas 14 had schedules that were actually shorter than what defendants propose. Moreover, not a single case cited by plaintiffs or defendants in which the schedule went longer than 110 days actually made it to a final adjudication after a trial on the merits. That is exactly what drives the Airlines’ concern here: that a trial delayed according to the plaintiffs’ schedule would knock the bottom out of this merger.

Both sides have valid points here, but it’s also hard to take just the comments here without taking a good look at the underlying data:

It isn’t surprising that all of the mergers that saw trial dates over 100 days in length ultimately were abandoned. In a world of quarterly filings for public companies and the amount of time that generally passes before government bodies like the DOJ and FTC ultimately voice their objections, it can be well over a year from the time the parties start negotiating with someone like the DOJ before they ultimately get to trial. That’s a heck of a long time to hold the strings together on a deal, especially when you consider that in a good number of cases we’re talking about mergers of competitors.

That’s not to say the DOJ’s position is wrong because of the significant impact on mergers when they take more time. But, it’s one heck of a “home court advantage”. Next:

“[I]nterested parties knew what should have been clear: that a merger of two large firms competing in already highly concentrated markets might draw an antitrust challenge.” (Opp’n at 3.) In fact, the DOJ approved three large airline mergers in the last five years using criteria that, if applied here, would demonstrate that US Airways/American Airlines is even more pro-competitive than the others.

Well, maybe two-and-a-half large mergers. Southwest was large but I wouldn’t consider AirTran to be “large”. They were roughly the size of JetBlue in passenger count when they were absorbed by Southwest. And, as much as the Airlines are right here about DOJ changing their metric, DOJ is well within its rights to do so. I’m not sure if it’s the right metric to use, but DOJ has a lot of latitude to determine if something is anti-competitive. Next:

“American reported record profits in the second quarter of this year.” (Opp’n at 3.) In fact, prior to its restructuring, American lost $10 billion in the last decade.

Not a bad reply on the Airlines’ part here. DOJ’s absolutely right, American is better poised today than at any time in recent memory to be profitable. But, American has lost a ton of cash over the past decade, and one small snapshot of this quarter doesn’t predict the future. The airline brief cites fuel costs as a possibility to wipe out profits in the future. No doubt, but I think a better example is if American really does start increasing in size rapidly. Excess capacity could lead Delta and United to consider dropping prices to compete with American in certain places, causing less profits for all of the big airlines. For the first time in a long time, the airlines are disciplined with capacity but it’s a fragile balance right now. Up next:

Consumers, of course, would also be harmed as the pro-competitive benefits of the merger would be withheld from them. Defendants conservatively estimate net direct customer benefits of $500 million per year from the merger, meaning that the five months of additional time sought by plaintiffs would result in a loss of more than $200 million in consumer benefit that cannot be recaptured after the Airlines prevail on the merits.

I’m sorry, but I just don’t see how American and US Airways can accurately calculate how much customers will “save” from a merger. I can’t imagine this argument holding a whole lot of weight with the judge when she makes her decision. Next:

“American’s restructuring efforts have been extraordinarily successful and have positioned the company to compete as a strong and vibrant standalone firm.” (Opp’n at 3.) Although American has made progress in restructuring, it has not yet presented an alternative plan to the bankruptcy court.

Yeah, this is a big “so what”. American spent a bunch of time trying to emerge from bankruptcy on its own in the beginning of the process. I’m not saying it takes twenty minutes to whip up a new plan. But, American is positioned to be successful. One point the Airlines bring up here that I do find highly relevant is airplane financing. American negotiated all its recent large purchases with very low financing rates. Those rates appear to be subject to them being out of BK. Remaining in bankruptcy while they compose another plan would likely be a big drag on interest rates for them in the short and medium-term, potentially even long-term with the uncertainty of rates right now. Still, that’s not DOJ’s problem. Next:

“The harm of delay is merely costs that American “may incur” and “some uncertainty” that “employees will face.” (Opp’n at 5.) This is a significant understatement of the harm attendant to a delayed trial. The Airlines conservatively estimate that this merger will result in net direct consumer benefits of conservatively $500 million annually. The pay raises and benefits improvements that have been promised to both airlines’ employees are put on hold―amounting to $400 million annually. That translates to nearly $2.5 million permanently lost for every day of delay. And American’s employees, entitled to an equity stake worth about $2 billion (at today’s valuations) when the merger is closed, would have to stand by and watch as the value of that equity is buffeted by the market.

To me, this is one of the more unfortunate parts of the current situation involving the lawsuit. Many employees are screwed and it isn’t going to get better soon. Union members who have been waiting years for the pay raises they believe they deserve got a small one from American but ultimately signed on to the merger (and likely the initial smaller pay increases) because they knew Doug Parker from US Airways was promising them more money in a merger.

Now, at a bare minimum they’re facing more delays getting those full pay raises. And, a very likely scenario where they never see them because they already signed contracts with American and the merger falls through.

They’re not the only ones hurt right now. Middle and upper management had already started preparing for the merger. That includes some preliminary layoff notices and people who made decisions to take buyouts from the company and move on. Some of these have been done publicly. That’s a pretty crappy ball of yarn to unwind. “Uh, Bill. We told you a couple weeks ago that we weren’t going to need you any longer. I know we promised you some severance and you already found a new job, but it’d be great if you stayed for a while longer. Oh, and no severance. Thanks!”

Again, not DOJ’s fault. But I do expect a fairly large amount of employee carnage over the next few months. Morale is already tough when they’ve been working through bankruptcy and merger discussions for almost 2 years.

At this point, I think the most likely outcome is that the merger will ultimately fall apart and American will emerge independent. A close second is a negotiated outcome with DOJ, which I still consider to be a real possibility here. I view the Airlines winning at trial the least likely scenario just because of the time involved. It’s a very real possibility that the trial won’t start until March. And, as the Airlines note in their brief, after the trial concludes the judge still has to rule. That could take a month or two. Is it worth 10 months for the Airlines to wait? I don’t think they can. But, there’s still a chance they succeed in moving the trial date to November or December. So, I’d say 40% likely no merger, 35% likely they negotiate a settlement and 25% chance American goes it alone when the exclusivity period ends in December.

We’re going to need more popcorn.

Related

One Comment