United’s Goldilocks Moment: Small Tweaks To Elite Status Qualification

After Delta drastically increased their requirements for earning elite status, and subsequently rolled back a number of those changes, frequent travelers were wondering what the other big airlines would do. Southwest had already spoken, making elite status easier to earn in 2024. United has now made their announcement. While they say there are no changes to elite requirements, there’s a bit of nuance to discuss.

With this sort of a headline, United is seeking to contrast the stark difference in their approach to elite status today versus Delta. And, things stay mostly the same. But, not 100%. For starters, they are reducing the “head start PQPs” they handed out last year. Current elite members will still get a head start, it’ll just be 50% less of a head start versus last year.

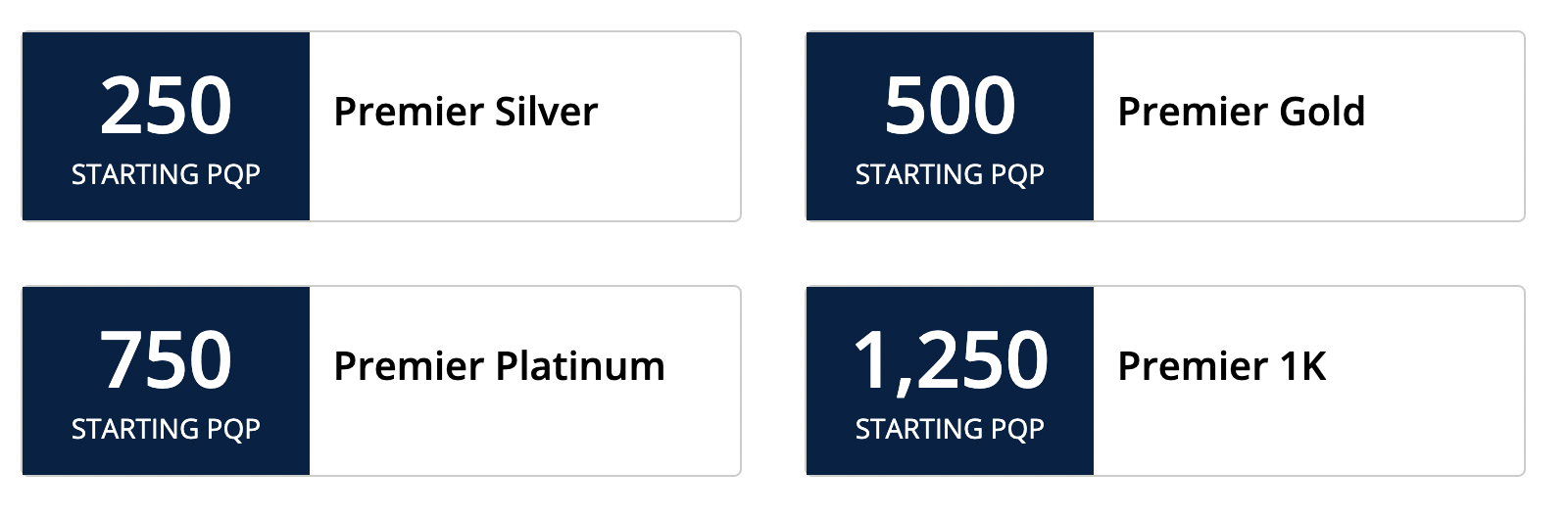

The accurate part is the actual qualification tiers don’t change. I put together a chart back in 2019 to help explain:

The accurate part is the actual qualification tiers don’t change. I put together a chart back in 2019 to help explain:

| PQP & PQF | PQP Only | |

| Silver | 4,000 PQP + 12 PQF | 5,000 PQP |

| Gold | 8,000 PQP + 24 PQF | 10,000 PQP |

| Platinum | 12,000 PQP + 36 PQF | 15,000 PQP |

| 1K | 18,000 PQP + 54 PQF | 24,000 PQP |

While 54 segments is a lot to lock down top-tier 1K status, it’s still achievable especially if you fly connecting routes on a regular basis. On Delta, you’d need to earn at least 28,000 MQDs, which means spending $28,000 on base airfare or combining a lot of airline spend with other earning in Delta’s ecosystem.

United Amps Up Credit Card Spending For Elite Status

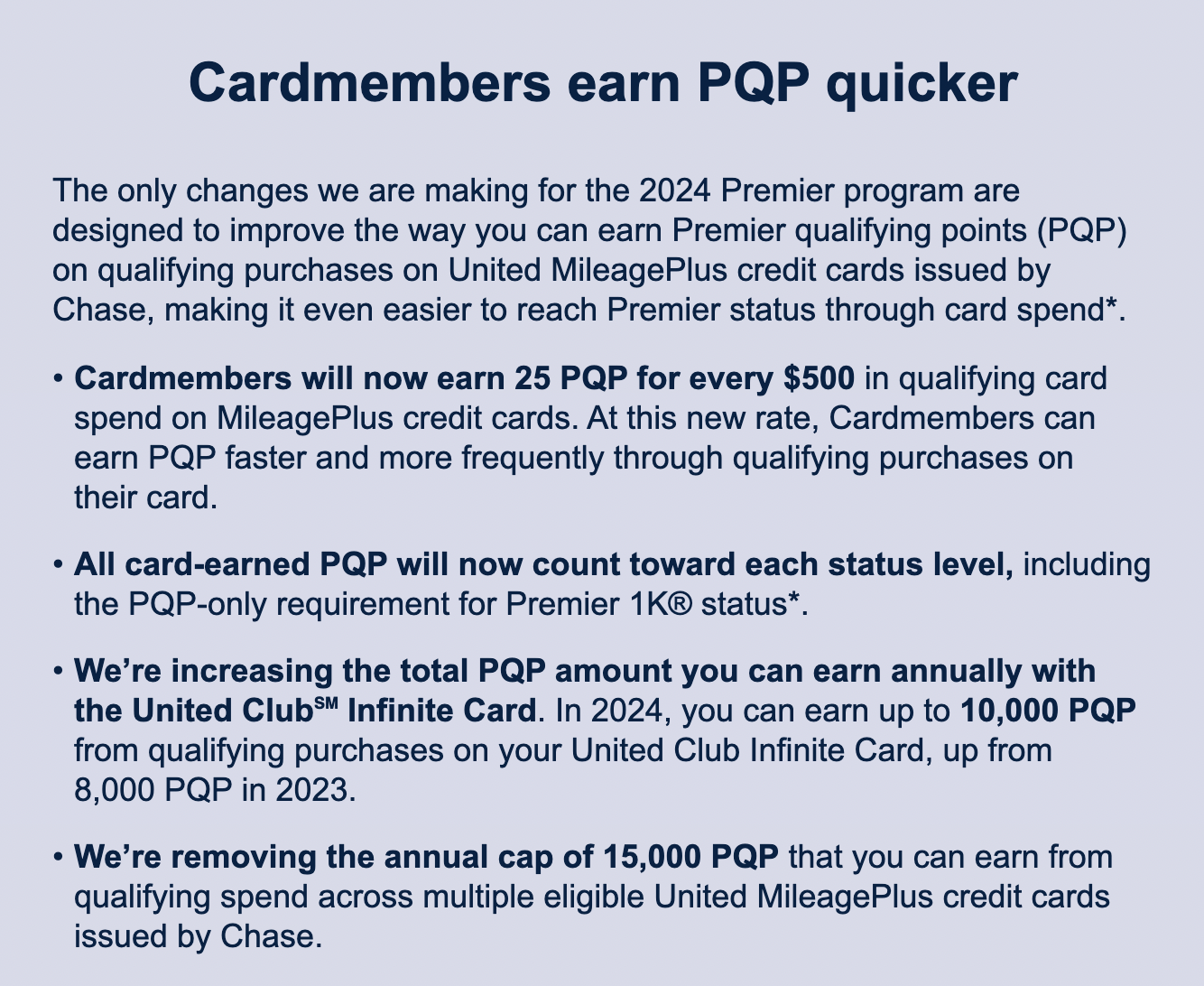

While current United elite members get a smaller head start on 2025 status earning, all folks chasing United status will have the opportunity to earn more PQPs from credit card spend.

Boiling down these changes:

- No more big spending threshold to hit to earn some PQPs. PQP earning starts at $500 in spend.

- You can now spend your way to 1K status.

- You can now earn more PQPs on individual credit cards and earn way more across multiple United credit cards.

United Is Close To Their Goldilocks Scenario

Some might see United’s lack of major changes as an act of benevolence. From my perspective this looks a lot more like United got almost exactly the results they wanted when they instituted these status qualification levels last year. They’ve trimmed back the head start PQPs but made it easier to earn status with spending on co-branded credit cards. On whole, these changes look an awful lot like a realistic interpretation of the current economic climate.

Interest rates are rising, folks generally have less expendable income. United likely projects that they’ll hit an ideal number of elite members by the end of 2023. Giving existing elites a little bit of a head start so they don’t roll into 2024 with a big goose egg is smart. If customers haven’t already started spending less on United co-branded credit cards, the airline may believe that’s likely to happen next year. They’ve given customers an incentive to put incremental spending on a United card (every $500 earns more PQPs on their most expensive credit card).

The Final Two Pennies

United and Delta are definitely headed in different directions when it comes to elite status requirements. There’s a good chance Delta started the year with more elite members than United. Clearly, the overcrowding of Delta SkyClubs is much worse than United Clubs. United seems to have done enough to hit their goals of ideal service levels for elite members in 2024.

United’s approach seems reasonable and measured in a time of economic uncertainty. Their lack of radical changes makes Delta’s changes look even more egregious than when they were first announced.

Did you enjoy this post? Please share it! There’s plenty of ways to do that below.

You can also follow me on Twitter, Facebook and Instagram.

And, I hope you’ll check out my podcast, Miles To Go. We cover the latest travel news, tips and tricks every week so you can save money while you travel better. From Disney to Dubai, San Francisco to Sydney, American Airlines to WestJet, we’ve got you covered!