You Can Now Apply For The Bilt Rewards Mastercard

If you’re a regular listener of my podcast, you’ve heard me and my co-host Richard Kerr talking about the Bilt Rewards Mastercard. Bilt Rewards is a new player in the points and miles space and they’ve also revolutionized how folks will pay rent, offering valuable rewards for paying your rent through Bilt.

They’ve rolled out some pretty cool promotions in the first year of existence, including a pretty sweet 5X promotion on Black Friday. My wife was also able to score a free exercise class recently in the Bilt Rewards app. It’s little touches like that which make holding this no annual fee card a no-brainer.

Many of you reached out over the past few weeks asking how to sign up for the card. Well, Bilt had entered a bit of a quiet period while they prepped for a transition to Wells Fargo. As of today, the Wells Fargo partnership is now public and that means no more wait list to sign-up for the card. Wells Fargo hasn’t really been a powerhouse in the points and miles. However, they’ve attracted top executives from places like Chase and Barclay to build a portfolio of cards. The Bilt Rewards relationship is definitely a big splash for them and hopefully a sign of more good things to come.

How To Sign-Up

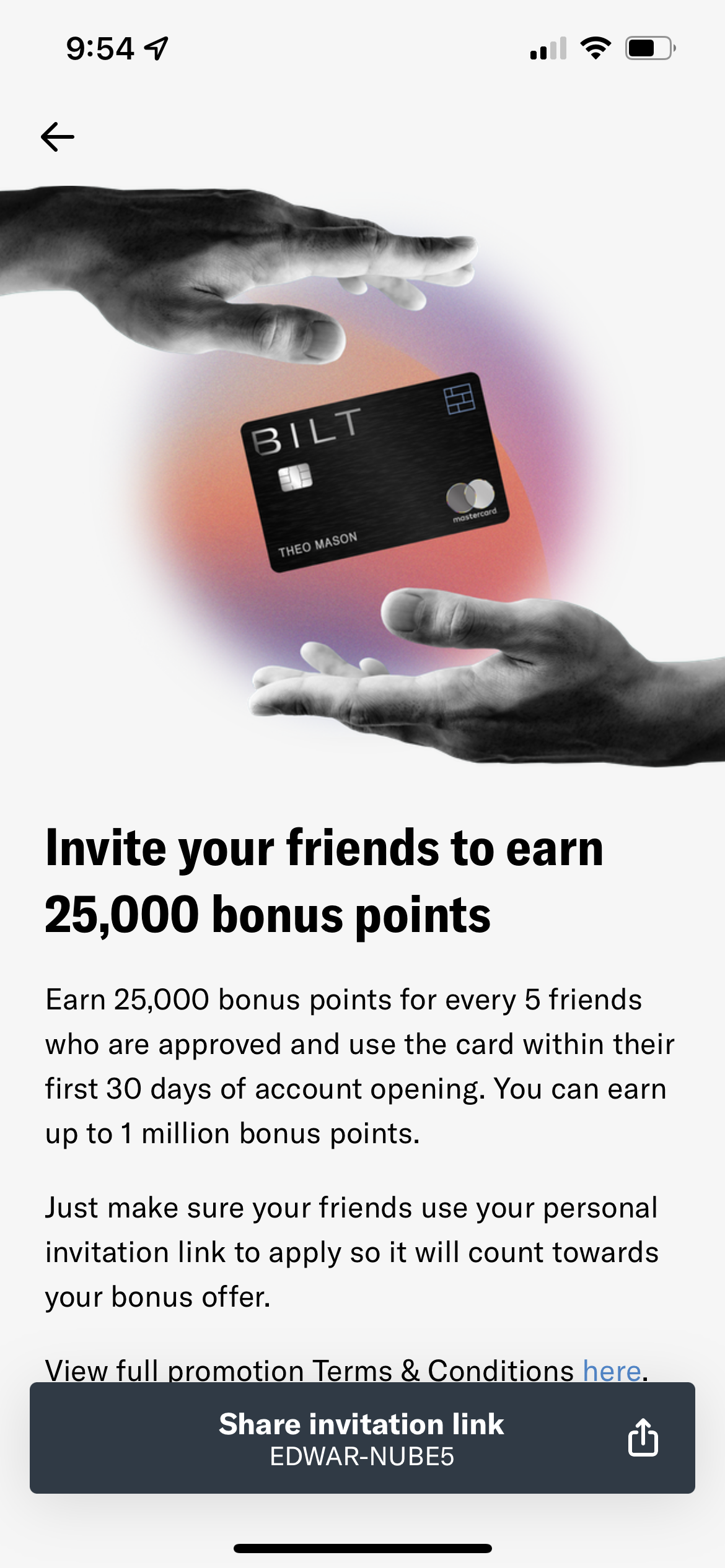

Call this my shameless plug to use my referral link for the Bilt Rewards Mastercard. While the card doesn’t have a sign-up bonus (or an annual fee), you can earn 25,000 bonus points for every 5 friends you refer who get approved for the card.

Once you’ve signed up for the card, you’ll have instant access to a card number and to the Bilt Rewards app, where you can invite others from the home screen for Bilt Rewards.

Why Apply For The Bilt Rewards Mastercard?

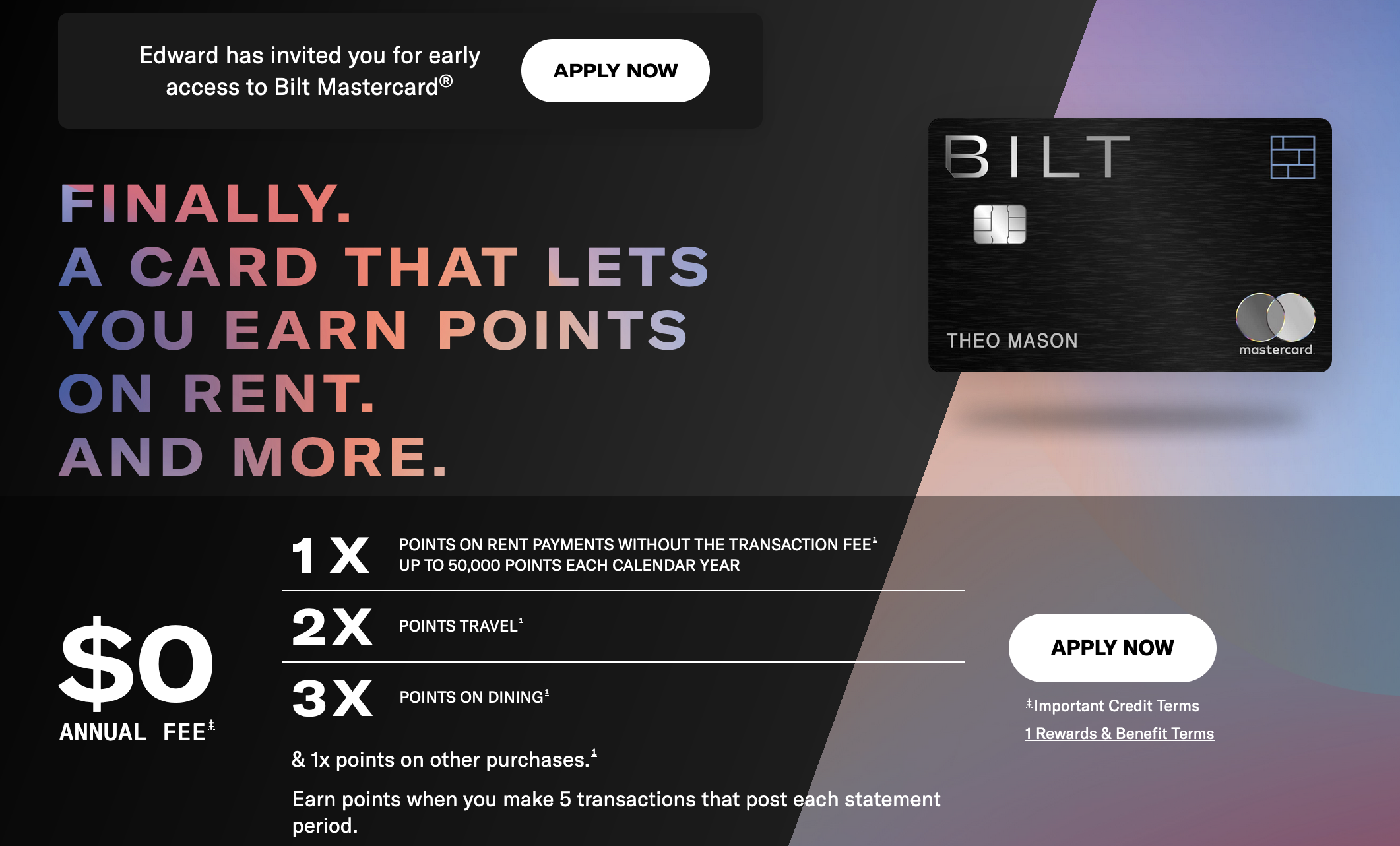

I took a bunch of flack on Twitter recently for asking the question whether Bilt Rewards was the most valuable currency out there. The flack was because I didn’t answer the question myself. Spoiler alert: I’m not answering it definitively here, either. I am working on a piece that discusses what sorts of cards are best for certain types of spending/redeeming. For now, I think it’s fair to say that any discussion of the most valuable points out there has to include Bilt Rewards. The earning proposition is pretty straight forward:

This is a no annual-fee card with an earning structure similar to the Chase Sapphire Preferred.

- 3 points per dollar on dining

- 2 points per dollar on travel

- 1 point on everything else, including up to 50,000 points for paying rent without a fee.

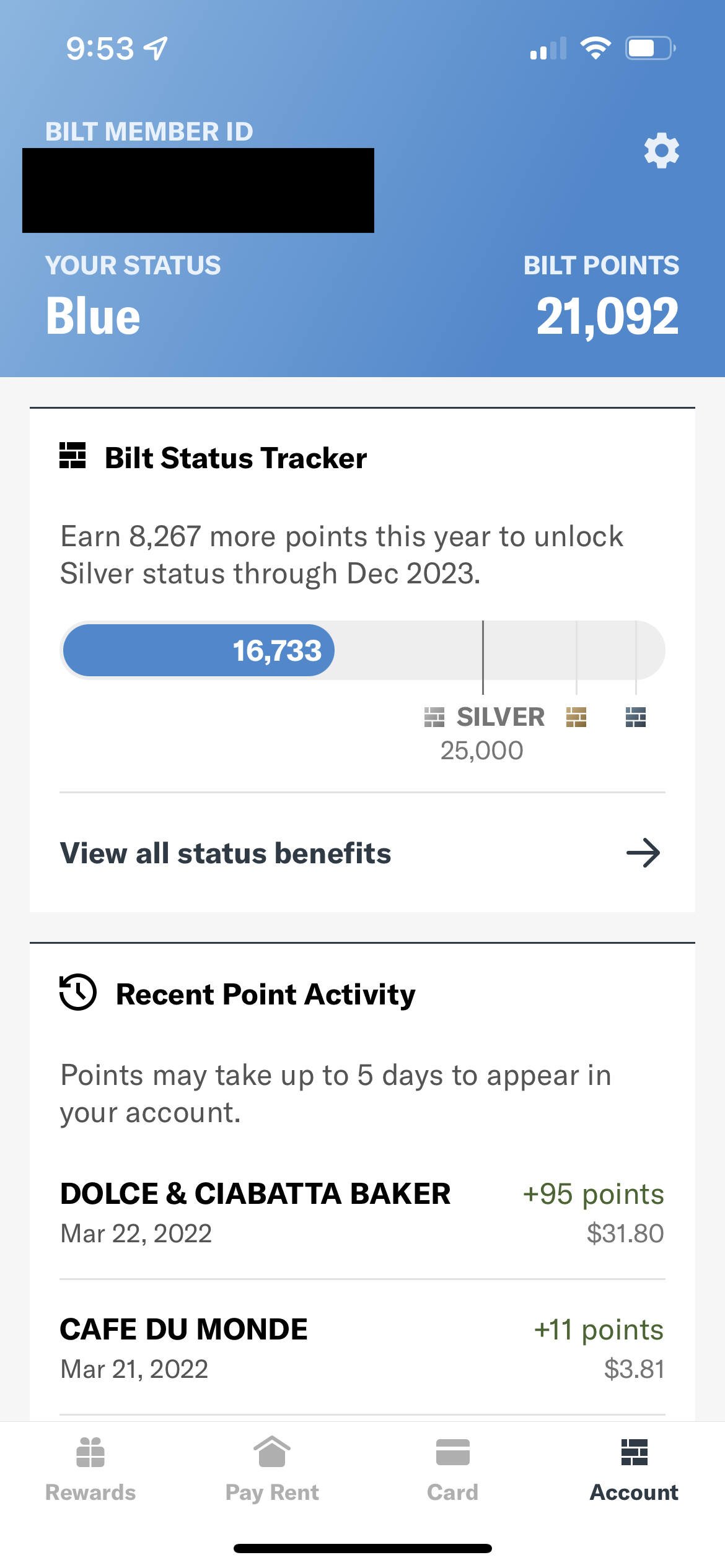

As you can see from my statement, I’m taking advantage of the 3X points on dining as I attempt to earn a higher level of status with Bilt Rewards (more on that in a bit).

They have a number of interesting transfer partners for folks who love to travel. The most interesting, in my opinion, is American Airlines AAdvantage, since they’re the only major transferable currency that you can exchange 1:1 for AAdvantage miles (not even American Airlines’ own card issuer, Citi, has any flexible earning cards that transfer to AAdvantage). Bilt Rewards also recently added United Airlines as a 1:1 transfer partner. Between American and United, you have plenty of destinations that are easy to book from the US. And, they have international partners such as Air Canada Aeroplan and Air France/KLM Flying Blue which open up even more options.

Renters will like the higher tiers of Silver, Gold and Platinum for bonus points on some leases. The benefit I’m after is the ability to earn interest on your points balance. You need to be at least Silver status, which I should qualify for shortly. After that, I’ll have protection against inflation in award pricing by earning some points each month based on my balance. This is a novel idea that won’t completely stave off future award price increases but still beats what any other major card issuer is paying to protect your awards balance right now.

The Final Two Pennies

There’s not a whole lot of downside to applying for a card with no annual fee (unless you’re chasing a mortgage or trying to avoid something like Chase’s 5/24 rule). I constantly preach to folks the true value to flexible points and miles. For years I was very loyal to American Airlines but haven’t been for over 5 years. That means my balance of AAdvantage miles has slowly gotten smaller. There are some very key routes AA serves which are always on my radar. Bilt Rewards allows me to transfer points there when I need to, instead of being locked into earning AAdvantage miles on a co-branded AA/Citi credit card. Those cards also don’t have great bonus categories, so I feel like I’m leaving something on the table with some of the spending I might need to commit to AA to earn enough miles for award flights.

Bilt Rewards has a startup mentality about points and miles, which I love. I’m obviously a big fan of Richard, since I tolerate him virtually every week on the podcast. His bosses, Ankur Jain and Dave Canty, are committed to a different path than most of the products out there right now. And, they really don’t like it when people tell them no. That’s really good for us as travel enthusiasts.

While you don’t need to use my referral link to sign-up for the Bilt Rewards card, I certainly appreciate it if you do. As many of you know, you won’t find a whole lot of referral links on my site or in my podcast. I’m a Bilt Rewards Mastercard member and I continue to use the card every month. Besides, if you apply for the card it’ll keep Richard from getting crabby on the podcast, and none of us want that.

Did you enjoy this post? Please share it! There’s plenty of ways to do that below.

You can also follow me on Twitter, Facebook and Instagram.

And, I hope you’ll check out my podcast, Miles To Go. We cover the latest travel news, tips and tricks every week so you can save money while you travel better. From Disney to Dubai, San Francisco to Sydney, American Airlines to WestJet, we’ve got you covered!

Hi Edward. Can you explain the purpose of your blog these days? You’ve written four posts in the last month, and three of them were either touting Bilt or Point.me, both in which you seem to have a financial interest. You have the right to monetize your blog, but the value proposition with readers only works when you mix it up with useful posts in which you don’t financially benefit – otherwise you lose your credibility. However, instead you’ve written six posts for The Points Guy in the last month. I just don’t get it.

Daniel, valid observations. Let me do my best to answer them. I don’t currently have any financial interest in Bilt though that could change in the future. As I disclosed about Point.me, the company that I’m a minority partner in does have a financial investment in Point.me. That’s a venture investment, so I don’t earn anything if you sign up for Point.me. The free memberships I gave away for Point.me are funded out of my pocket, not from any income I receive from Point.me. While it is possible that I will receive financial upside from our investment in Point.me, venture investments generally have an 8-10 year horizon (and 90% of them literally go out of business with no financial return).

Richard Kerr, who’s the co-host for my podcast and a great friend, works for Bilt Rewards and I’ve been lucky enough to have some inside looks into what they’re doing. I’m a big fan of the product. Similarly, Adam and Tiffany at Point.me have been friends for a very long time. I’m super excited for what they’ve built and I think it’s an INCREDIBLE product for points and miles geeks. It’s literally the best tool I’ve used in years.

Anyway, short story is I thought that Bilt adding United as a transfer partner was pretty cool. And, I’ve had well over a dozen people ask me for “cut the line” codes for BILT over the past couple of weeks. And, I think every point/mile geek should take a hard look at Point.me.

The TPG stories were previous promises I had made to friends there to help out (one of those promises was months ago). I want to honor those promises.

No question I haven’t written as much for PIM during the pandemic. If that means you wander away from the blog, I’ll definitely be sad about it. Ultimately, I still LOVE writing. I’ve got a post about my Freddie ballot that I hoped to get done today but I needed to help my wife with a project. I’m hoping to finish it up tomorrow. And, I’m hoping to write more on my own site. But, I’m past the point of promising and breaking promises. I’m an under-promise, over-deliver sort of guy and I want to get back to writing on a more regular basis. If you could ask the pandemic, supply chain and staffing issues to go away, I’d really appreciate it.

Anyway, thanks for sharing your thoughts. I’m always happy to hear from readers, even if it’s not happy stuff. 🙂