Miles And Points Are Just Like Dollars

Or euros, dinar, pesos, rubles, etc.

People ask me why I spend so much time writing this blog. I can assure you there’s no pot of riches that I’m cashing in on as a blogger. While I do make a few bucks, the hourly rate I “get paid” for the time I put into the blog would be horrendous if I tried to calculate it. But, what’s rewarding is when a reader gets it. Points and miles can lead to awesome travel experiences. And, while that’s the reason I collect them, you need to realize they’re currency.

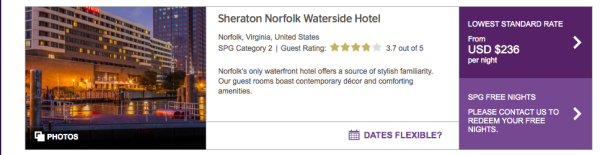

I had a friend call me today with a rhetorical question that exhibited he really understood that his miles and points were in his wallet alongside his $20 bills. His rhetorical question? “Is it worth 4500 Starpoints to stay at a hotel that’s charging $236 a night?”

For just a second, I honestly thought he meant 14,500. But, it really was a rhetorical question, since he’d found a Category 2 property in the city he needed to stay that was charging over $200 a night:

That’s about 5 cents a point in value. I generally value Starpoints around 2 cents a piece, so this is a great redemption.

Conversely, another friend just got done redeeming United miles for a second time for an iPad. He exchanged roughly 70,000 miles for an iPad worth about $500. That’s less than 1 cent per mile. In our discussion about it, he said that he wasn’t willing to spend the cash but was willing to spend the points. He characterized the issue as a difference of opinion between the two of us. I guess I can understand why he thinks that way, but I posed the question to him, “If you had lots and lots of money, would you be fine paying $6 for a gallon of gas instead of the current $3-ish prices at the pump?”. Similarly, you get off a plane in Europe and there were two currency exchange booths side by side. You want to exchange 100 US dollars for euros. One booth will give you 80 euros while one will give you 90. Are you really going to take 80 euros?

And, that’s really what this boils down to. Are you getting the best value you can for those miles? In this case, our iPad purchaser has a job that generates lots of United miles from flying. He views those miles as more disposable than his cash since he expects to continue earning lots of them. If he had an unlimited (or very large) amount of miles or cash in the bank, that could change the thesis here. Or, if you were going to have to charge the $500 on a credit card and pay interest, then the strategy for redeeming miles changes greatly.

But, when you consider an expectation of earning more miles in the future (which could change), you also have to consider that you have a reasonable expectation of earning money in the future (from your job).

Put another way, those 4500 Starpoints would transfer to 4500 American Airlines AAdvantage miles. 4500 AAdvantage miles wouldn’t even buy a saver round-trip ticket in the US (25,000). You’d need more than 5 times the number of miles. And yet, we see the example above where redeeming those Starpoints at the Sheraton Norfolk saves us $236.

If you had 70,000 United miles, you could redeem them for:

- A coach saver award to Europe (and still have 10,000 miles left over).

- Almost 3 coach saver awards in the US or Canada, excluding Hawaii (you’d need 75,000 miles).

- One roundtrip coach saver award in the US or Canada AND one roundtrip coach saver award to Hawaii.

In all of these cases, I think it’s easy to see that you can get more than $500 in value out of those 70,000 United miles.

Everyone has to come up with their own value for miles and points, and those values will change over time depending on different situations like how much cash you have and what your mileage/point balances are. In extreme cases where you have very little cash or an unbelievable amount of miles, it can be okay to redeem at a lesser value.

But, if your thought is that you have a lot of miles so it’s okay to spend a lot, you’re missing the point (pun not originally intended).

Focus on what your points and miles can buy you in the best of circumstances. Know how much value you can get when you’re getting the best opportunity to redeem and evaluate other opportunities against that best case scenario. Remember the gasoline example. Don’t pay $6 for a $3 gallon of gasoline.

I got my nephew into the miles/points game. He recently redeemed miles for a cruise (or something like that) and got less than 1 cent per point. I told him never to redeem miles worth nearly 2 cents for less than 1 cent. He scoffed at me and said “what can be better than free?”. I responded as we all would in this game: “more free!”.

If you use 70k points on a trip to Europe that you never would have taken if not for the points, then you aren’t getting as good a value as you think because you still need to spend that $500 on your iPad.

If you spend your 70k points on a $500 item that you would have bought anyway then you are getting true value out of your points. It’s all about priorities and what your plans are.

Cj, sure. Except, my friend enjoys traveling for fun as well. So, he’s giving up value.

Generally I agree, but they are not the same. Dollars and Euros have near perfect optionality; points do not. This is why the value of points will always vary from person to person. Everyone has determine for themselves what those points can buy and how much they value them. Dollars, well there’s not a lot that I can’t redeem dollars for.

Ben, the value of points is variable, no doubt. But, only to a point. If you’re really going to redeem points at less than a penny, you’re probably better off earning something else (unless you solely earn from flying/hotel rooms).