Earn 1,000 Rapid Reward Points While Filing Your Taxes For Free

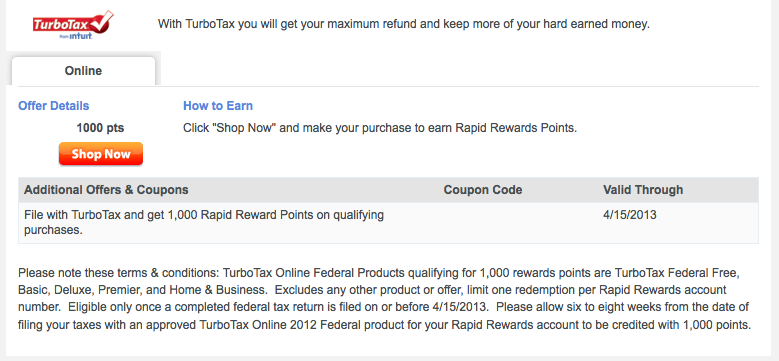

It’s entirely possible there’s an offer out there somewhere else, but this is the first I’m seeing it. Southwest is offering 1,000 Rapid Rewards Points for filing your taxes with TurboTax.

As you can see from the terms & conditions, you can earn 1,000 points for using the TurboTax Federal Free service, which is essentially a 1040EZ. So, if you don’t itemize, here’s an easy 1,000 points.

awesome !!! makes having to pay taxes a bit easier LOL

Wow, that was quick! I just got a message from Southwest a minute ago, and you have already posted about it!

I got excited for a minute, because we use Turbo Tax. But, then I read that you can’t itemize. ;-(

Chris,

You can itemize and still get the 1,000 points. My comments about itemizing was if you don

I rather pay my account via a bluebird check

Perry, I would prefer to pay and get miles as well, but if it’s free and they’re offering Rapid Rewards points, those that like Southwest are sure to be pleased. Me, I’m not exactly the Southwest type. 😉

Just logged into my BOFA account and notice they are now offering free weekend passes to museums throughout the year. Just wanted to give you a heads up!

http://museums.bankofamerica.com

Perry, thanks for the tip!

I use TurboTax every year so this would be great, thanks!

If only I didn’t plan to avoid paying taxes and escape to somewhere without an extradition treaty…..

Jeff, if I was awarding prizes based on humor level, yours would be a finalist!

BigCrumbs gives 10.5% back on Turbotax purchase.

Thanks!

Mauai

Having an accountant friend is killing my points earnings.

Dan,

There are some that wouldn’t consider 1,000 Rapid Rewards points “earning”. 😀

This is the best deal I have seen too. All the rest are dollar based which will net you probably around 350-700 points or miles.

Since Rapid Rewards offers fixed rather than mileage-based rewards, 1000 miles is worth about $17 on “Wanna Get Away?” fares or $8 on “Business Select” fares.

Depending on how much you are spending to file, H&R Block may be a slightly more rewarding option. If you are spending $67 or more at H&R Block (not difficult if filing both Federal and state, as my invoice last year was $69.92 for their deluxe versions) and own one of these cards (Chase Sapphire Preferred/Ink Bold/Ink Plus), it is better to go through Ultimate Rewards instead (1 purchase point + 15 bonus points per dollar). You can transfer those points directly to Southwest at a 1:1 ratio. My H&R Block payment last year would have earned me 1119 Ultimate Rewards points which would have equalled 1119 Southwest points.

The current online cash back options for H&R Block according to http://www.evreward.com are 14% for BigCrumbs, 12% for Mr. Rebates, and 20% for Shop Discover (for those of you with a Discover Card). Respectively, you would have to spend $122, $142, or $85 at these portals to receive an equal value to the “Wanna Get Away?” redemption. These cash back options do not include the additional points and associated value that you may be earning directly through your credit card usage.

For reference, Turbo Tax’s cash back amounts for the same portals are currently 10.5% (BigCrumbs), 8% (Mr. Rebates/ebates), and 15% (Shop Discover).

James, great info for the majority of people with slightly more complicated taxes. Thanks for sharing!

Not worth it for me, but thanks anyway.

I don’t normally use turbo tax but nice offer for those who do.

That’s pretty cool from where I stand. I use Turbo Tax every year anyways so might as well earn some free points while I do it!

Got the 1000 Rapid Rewards points last year and will do so again in 2013!

Ah, I wish my tax situation were simple enough to qualify for the 1040EZ!

I plan on getting miles from filing taxes somehow this year, just haven’t decided on how yet. Thanks for the info!

Not a problem. Hope it is helpful!