Whoa! (Targeted)10 Points Per Dollar On All Spending On Advantage Aviator Silver MasterCard

We all know airlines and hotels are hurting right now. The COVID-19 pandemic has been brutal. In a nod to the reality that 2021 isn’t likely to be a “normal” travel year, some brands are already making big moves. Hilton was the first hotel chain to lower elite status requirements for next year. Airlines are jumping in, with American Airlines going first and United not far behind. But, it’s not just enough to lower status requirements. That only helps generate revenue if people want to travel and your value proposition makes them want to choose you. It’s a lot easier to unlock value in your loyal customers right now if they hold one of your credit cards. But, it’s still not easy. That’s because so many credit cards are offering new bonus categories and benefits to keep customers engaged.

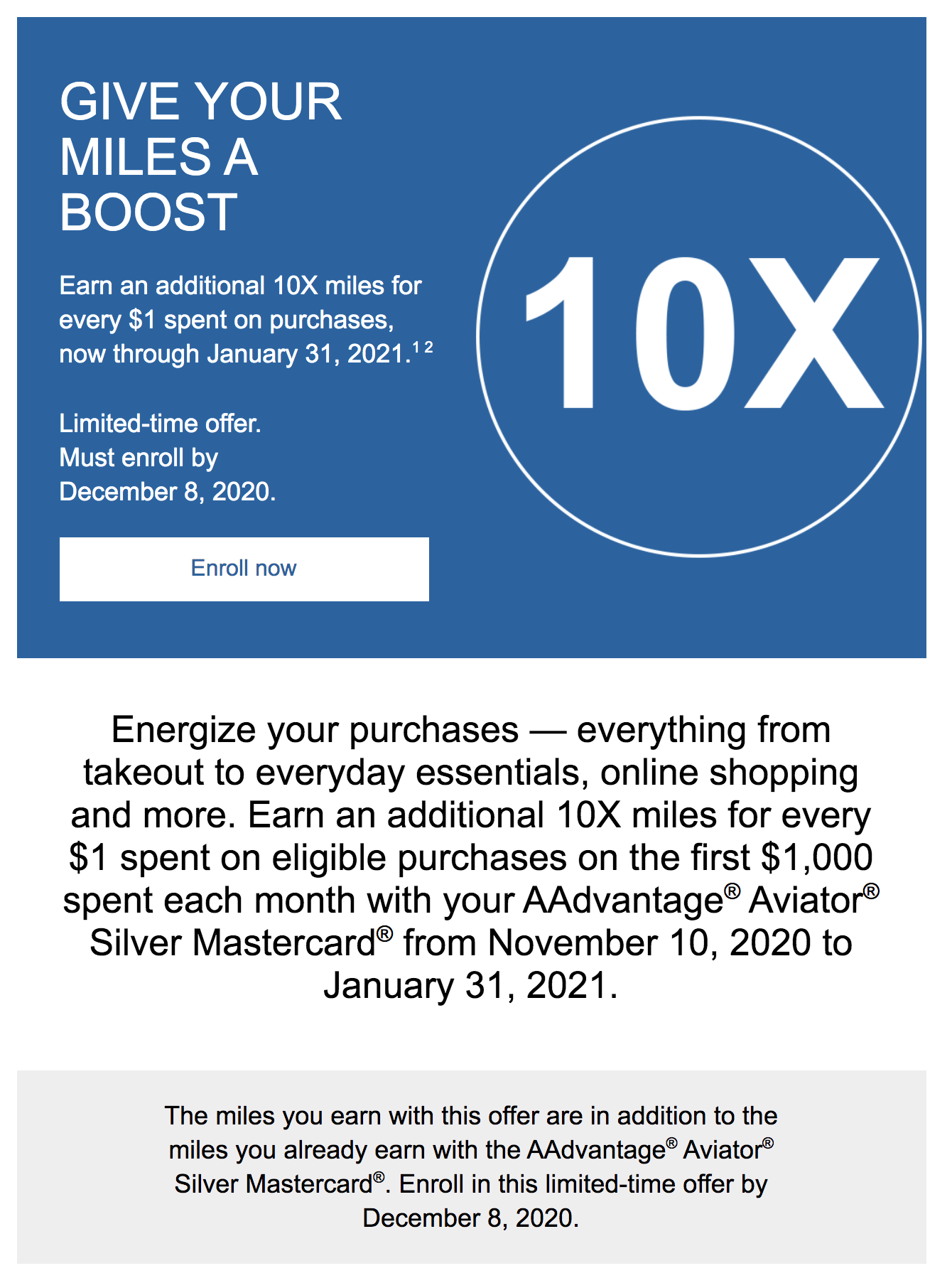

One of the credit cards I hold is the AAdvantage Aviator Silver MasterCard. You can’t apply for the card right now. I got it by upgrading from the Red version of the card. They sent me a fabulous offer this evening:

This offer is targeted but you should absolutely check to see if you were targeted. It’s a really, really great offer.

ETA: There appear to be a lot of targeted offers on Barclaycards right now. Nick at Frequent Miler has a healthy list going.

I honestly can’t recall an “everyday spending” offer on a credit card that was more lucrative. Spending $1,000 each month on this card would earn me 11,000 AAdvantage miles per month. The card does carry other bonus categories (for American Airlines purchases, hotels and rental cars) but I don’t play any spending in those categories. Still, it’s a complete no-brainer to register for this promotion and earn 30,000 bonus miles I wasn’t expecting.

The Final Two Pennies

This was a credit card I’ve been thinking about canceling. I’m not flying right now (and probably won’t again in 2020), and American Airlines is a tough airline for a business traveler to commit to out of my home airport of Washington-Dulles. I got rid of the Citi/AAdvantage Executive World Elite MasterCard last year. The $450 annual fee was tough to justify without visiting Admirals Clubs. With no travel in the forecast, the Aviator Silver card was definitely something I’d have to think hard about when it came to justifying the $195 annual fee. I also hold the $99 annual fee Citi AAdvantage Platinum card, so I do have a way to earn AAdvantage miles from everyday spending if I choose to do so.

30,000 bonus miles are worth more to me than that $195 annual fee. How much more? Hard to say in the midst of a pandemic, with so much uncertain. But, it definitely feels like it’s worth holding on to the AAdvantage Aviator Silver MasterCard for at least another three months.

Did you enjoy this post? Please share it! There’s plenty of ways to do that below.

You can also follow me on Twitter, Facebook and Instagram.

And, I hope you’ll check out my podcast, Miles To Go. We cover the latest travel news, tips and tricks every week so you can save money while you travel better. From Disney to Dubai, San Francisco to Sydney, American Airlines to WestJet, we’ve got you covered!

It gets even better — many people are receiving an offer for an additional 50K after $3K spend for 60K total miles. Offer is out on many Barclays cards. We’ve posted a list. Going to add Aviator Silver to the list now.

Holy jeebus! I’ll add a link to your post in mine.

I got it for the no fee Barclays Arrival World Mastercard – of course American points are worth more than a penny (ok 1.05 cents with the point rebate)

Earn an additional 10 miles for every $1 spent on purchases made from November 10, 2020 to January 31, 2021, up to 10,000 miles.

The miles you earn with this offer are in addition to the miles you already earn with your Barclaycard Arrival™ Mastercard®.

Plus, earn 50,000 miles when you spend at least $3,000 on purchases from November 10, 2020 to January 31, 2021.

PS – this Barclays (US division of a British bank) card has PIN technology that (mostly) works in Europe. While travel reward earnings are so-so I never travel internationally without this card in my wallet. Absolutely life saver when you encounter an unmanned gas stations or public transit ticket machines that require a “real” pin card. As far as I know the PIN on all credit cards issued by ALL American banks and Amex is only for ATM cash withdraw at an astronomical fee.

Jon, you got a pretty incredible offer there! I hope you plan on maxing it out.

ED

Absolutely will max out Barclay offer on my Arrival card . This 50K is same amount I got when I applied for Barclay Arrival Plus ($89 fee) which I downgraded to no fee Arrival after two years when fee was due. Very surprising to get such a great offer on an inactive card that does not have an annual fee. I do make a point of running at least one charge though all no fee cards yearly to avoid auto closure by banks. Shame, neither fee or no fee version of the Arrival card is available to new applicants. Love to try to Churn back into Arrival Plus.

Everyone should have at least one “reimbursement” card .

When I was new to miles and points I unsubscribed to credit card marketing emails and missed a lot of great offers.

Good to check your email preferences when on bank’s website and make sure you have them turned on.

Well, time to cancel another itinerary – damn I miss my (travel) life.