United Increases The Minimum Price Of Many Award Flights, Which Leads Me To This Question

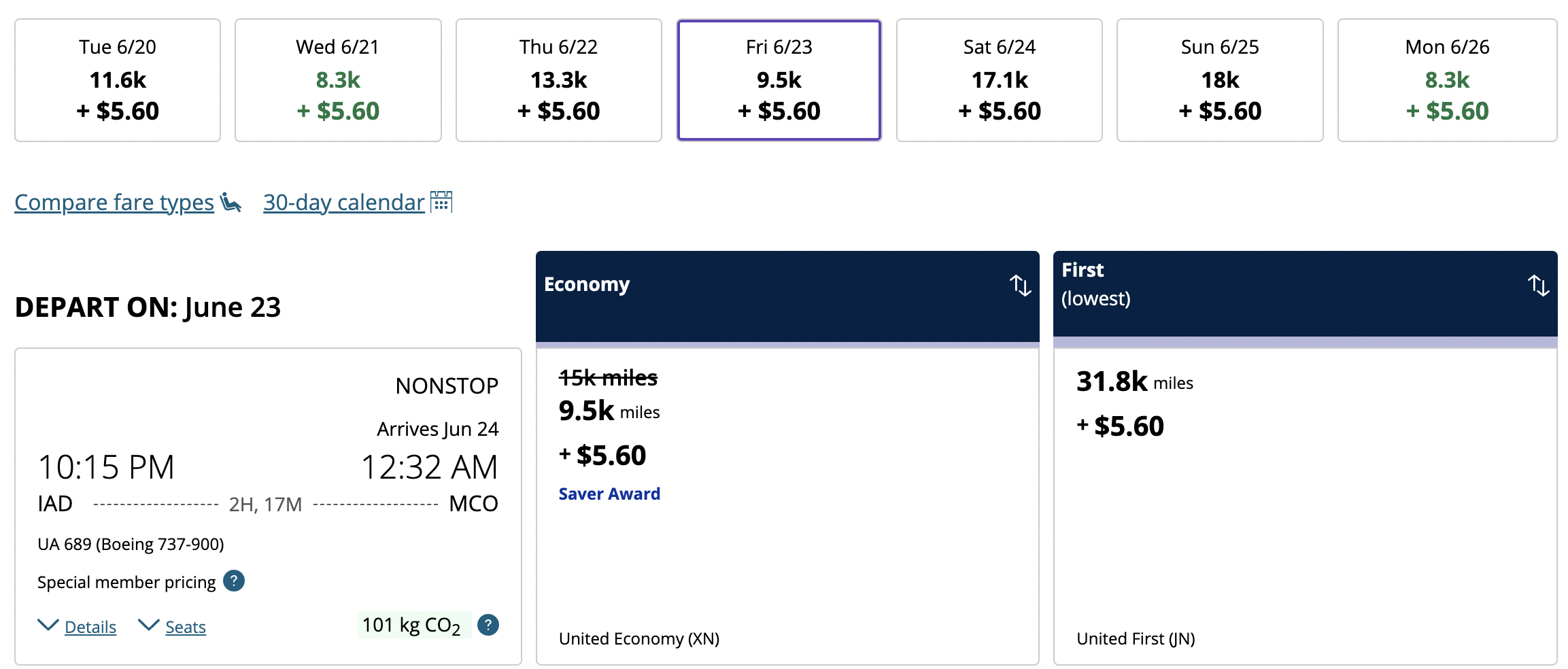

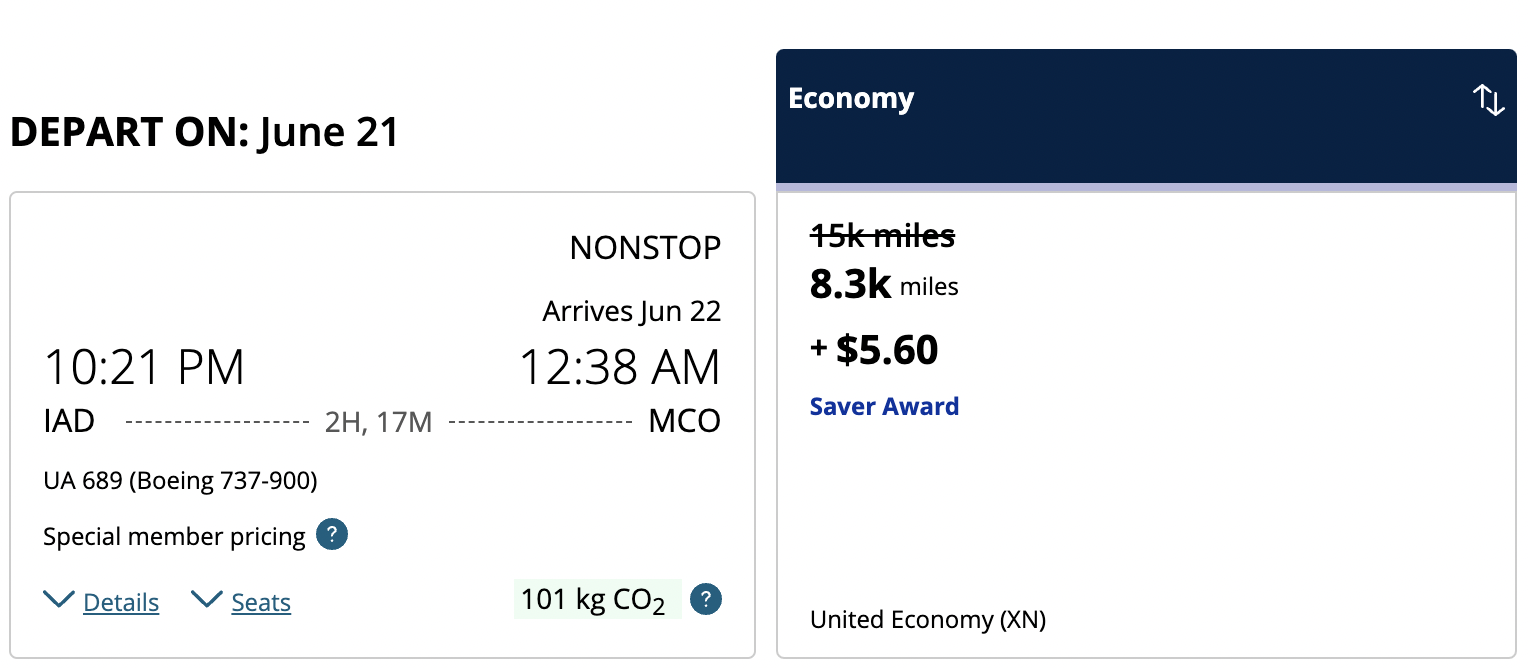

I’ll admit, I hate the term “devalue”. That’s the term many travel bloggers use to describe when airlines increase the number of miles or points necessary to book award flights. To me, this is a price increase on awards. The reality is that many award flights United offers have gone up in price over the past few months. The initial changes were reported by many as “overnight” changes, though the changes were a bit more subtle than that. Many awards started to show higher pricing a few months ago based on my searches for summer vacations.

More recently, the past week has seen much higher pricing for partner awards (when you use your United miles to book a flight on Lufthansa, ANA or another airline they have a partnership with). Some of these increases are as high as 50% more miles required than a few weeks ago. On many routes, United also charges a small premium if you’re booking close to your departure date. However, this is not uniform. On flights where it appears United thinks they won’t fill the plane not only are award prices cheap (cheaper than 10K miles one-way in some cases), there is no “close-in” premium.

The changes are bad, but not uniformly bad. There are still pockets of value. It’s really hard to tell exactly how much value right now because travel demand is still very high. I commented on my podcast a couple of weeks ago that I was watching a few United flights to the Caribbean. United has consistently priced those flights at 70,000 miles, one-way in coach for the past few months, prior to the most recent price increases. That stands in contrast to sub-$400 one-way cash fares, a truly horrible value for redeeming miles. While these changes are truly bad, I think we need to wait for travel demand to drop just a bit to understand how widely available saver awards will be.

Why Do Airlines Increase Award Prices In This Fashion?

Gary of View From The Wing wrote earlier today about Chase and United offering increased bonuses on new credit card sign-ups right now. He notes that when United passed through large increases a number of years ago that Chase pushed back on such drastic changes. Gary also notes that maybe United thinks their customers won’t notice this latest price hike:

In the old model, United gave three months’ notice of these major changes. They announced them. Now that United has eliminated award charts, they do not tell customers about the changes at all. So any reaction likely comes when customers begin to realize their points are worth less, which is redemption time. Perhaps United’s bet is that customers won’t notice at all.

Prior to reading Gary’s post I was recording a podcast episode for release later this week and I asked my co-host, Richard Kerr, a question. He loves Waffle House, in a bit of a crazy way. I asked him if Waffle House raised the price of his favorite entree 50% how he would react. He said he’d be shocked. I also asked him if they raised the price of that meal over the past few years. He quickly replied that they had, numerous times.

As consumers, we’re trained to expect price increases. We don’t like them, but we expect them. Sometimes, the price of a gallon of OJ goes up 20 cents. Other times they decrease the size of the packaging a bit and hold the price, effectively increasing the unit cost. Side note: the airlines are experts at shrinking the offering while holding the price steady.

Why don’t airlines increase award prices gradually? By and large, airlines have eliminated award charts. There’s no need to wait and pass through a 30%-50% price increase. A counter argument might be that partner agreements lock in prices for periods of time. However, it’s in all the airlines’ best interests that customers not have sticker shock. Call it an over-simplification of the issue, but the airlines use a different price increase model for award prices than most other businesses.

The Final Two Pennies

United pushed through some pretty massive award price increases recently. They didn’t even increase everything at once, instead splitting it up into a few separate tranches (though each increase itself seems to be significant). That meant even more stories from bloggers about “the next shoe to fall”. United created their own bad price with large award price increases. Then, they did it again a few weeks later.

You can certainly make the argument as to whether United should have increased their award pricing.

However, if they planned to increase award pricing, it’s hard for me to agree this is the right way to have done it.

Price increases are inevitable, whether small or large. However, travel points do have a major downside compared to currency.

It’s not okay for reward programs to universally devalue points. For example, 10 flights flown should equal one flight earned, over time.

Travel providers have three levers to control costs of travel points. How many points are earned for an activity, how many points are required for redemption for an activity, and how many points are transferred for an external input (ie credit card point transfers).

Unlike cash, rewards points do not earn interest and cannot be invested. If I can get a hotel stay for $100 in 2023, with going inflation of 5%, I could get the room for $105 in 2024, I can invest my savings of get a return of about 5% and get the same room next year. The concept of net present value.

As such, a traveller’s best route for point redemption as their points are devalued is the earn and burn method. This inevitably leads to less member loyalty and more erratic redemptions.

Just as stable currency, inflation, and interest rates lead to better economic prosperity, so would stable rewards programs increase loyalty and consistency.

I urge United and other travel provider executives not to model their rewards program Argentina’s fiscal policy, for the sake of a quarterly bonus.

I agree that points have generally proven to be worth less over time. I still like keeping a stash of points for emergencies or once-in-a-lifetime opportunities, but it’s hard to argue with earn and burn.

Absolutely. As long as points aren’t directly tied to cost for all rewards, having some points gives you options.

With no award charts, the award levels are getting to be more and more of a mystery. As a result, I am now a free agent and have no loyalty. I am trying to burn miles. I successfully burned all United miles to less than 1,000 miles. I have not yet burned significant Delta or American miles. Delta awards are insane, like 100,000 miles each way for an economy international trip. Someday, it will be 500,000 miles each way.

Derek, it’s the absence of award charts that puzzles me the most about these big price changes. And, yes, many Delta award prices are pretty crazy.

If everyone stops using their United card (as we did) maybe Chase will get the message. United does not seem to care.

You’re right, but that’s a tall order. I’ve stopped charging on mine but I suspect lots of folks won’t notice the price increases until much later.