Alaska Air Acquisition of Virgin: What Can Customers Expect

This is my second of two parts discussing the combination of Alaska Airlines and Virgin America. If you’re interested in the key business points of the deal please refer to my previous post.

While Alaska Airlines and Virgin America serve the same sliver of the market, they do it in different ways. Alaska Airlines has had a top performing airline where it pertains to customer satisfaction for quite some time. They have a loyalty program that’s respected by many frequent travelers. The inside of their airplanes isn’t very flashy, but their employees are very friendly. They subscribe to a mantra where they believe in providing wifi so customers can bring their own devices on board to watch movies, surf the net, etc.

Virgin America is best referred to as “trendy”. They are also well-respected by their customers and generally score well on customer satisfaction. They have “mood lighting” on board, seat-back monitors that allow for watching movies, ordering drinks or texting your neighbors in flight.

Which culture will prevail when it comes to in-flight products? I suspect it will be Alaska. They have a solid management team and loyal, passionate customers. Virgin America has the same, but they’ll lack a seat at the management table to advocate for their preferences.

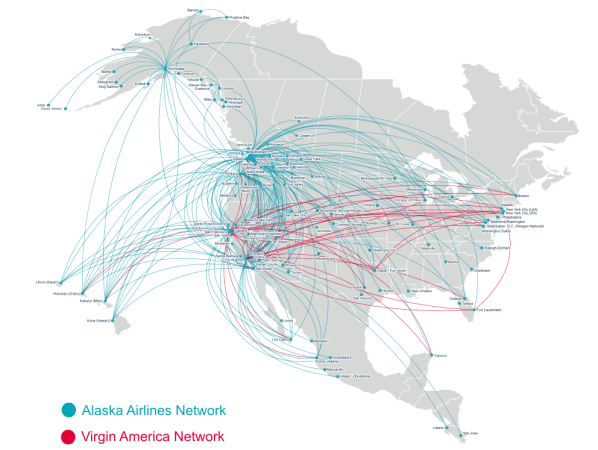

Network

While the increase in the size of the network benefits customers of both airlines, it should more beneficial to Alaska Airlines customers. In the past, an Alaska customer living in California relied pretty heavily on partners like American Airlines to get to secondary cities located anywhere to the East. And, while they have a decent network from Seattle and Portland, it has plenty of gaps and lack of frequency. An Alaska customer in Portland might have to connect in SFO to get more options in the new combined network, but they’ll be able to earn points in one program in an effort to help build up status.

Alaska Airlines has a smaller fleet of airplanes that used to fly under the Horizon Air name. That fleet is all turboprops now (but potentially transitioning to jets). Those plane sizes are much more appropriate for short-hop flights from both SFO and LAX. That would put them in direct competition with their partner, American Airlines, at LAX, but could open new markets for them at SFO competing with United Airlines. Those planes currently serve other short-hop routes in the existing Alaska Air network, so more to follow on this.

Loyalty Program

Virgin America and Alaska Airlines think very differently about loyalty. Virgin America awards points based on how much you spend on your airline ticket. The redemption model is the same (and similar to Southwest Rapid Rewards) in that you redeem points on something of a fixed scale based on the price of an individual ticket.

There’s no path to earn free upgrades to their awesome first class product. However, Elevate members can earn upgrades to their version of premium economy, earn extra points and get a free checked baggage allowance. There’s also some access to a few Virgin-branded lounges.

Alaska Airlines is more of an “old-school” frequent flier program, rewarding based on how many miles flown versus how much someone spends. They offer a broad suite of benefits to their elite members, including all the specific pieces you’d expect like bonus miles, first class upgrades, baggage allowances, companion upgrades and more.

Alaska recently did have a very customer unfriendly moment when they devalued Emirates awards in a heartbeat. But, for the most part they’re good stewards of their program and provide a really positive experience for their members. They’ve already said that their getting rid of the Virgin America Elevate program, and they appear to be committed to a mileage-based program for at least the foreseeable future.

Pricing

There are some interesting implications here as it relates to pricing. Alaska and Virgin don’t compete directly on very many routes now, so there may not be an immediate rise in pricing on a meaningful number of routes based on this consolidation.

However, depending on how Alaska proceeds, they could have an impact in the market that Virgin didn’t. Virgin did a fair amount of competing on price with the likes of American, Delta and United in the lucrative transcon market. Alaska specifically noted in their discussion of the deal that they wanted to compete in this market.

I nodded when I heard this, thinking they could compete on those routes and benefit from the strength of their loyalty program as a small feather in their cap. However, a post by Ben from One Mile at a Time drew me back to one of the obvious points:

- “This allows Alaska to compete in the transcon market.” That’s definitely a valid point, though Alaska doesn’t need a merger to make that happen. They operate all kinds of 1-2x daily transcons, though haven’t expanded all that much beyond Seattle. That seems to be a conscious decision, and not due to lack of opportunity. Sure, this would allow them to enter the New York to LA/SF market, but how do they plan on tackling that? Are they going to keep around the Virgin America brand and get rid of the Alaska brand in order to do that? Are they going to finally upgrade the Virgin America first class seats so that they’re competitive in the market? My point is simply that it seems like a conscious decision up until now that Alaska hasn’t competed more on transcons out of other markets, and it’s because that’s not the core of their business. Alaska doesn’t try to be all things to all people, and that’s precisely why they’ve been so successful.

For Alaska to compete on these routes, they’d likely have to forge one of two paths. The first would be a commitment to a high-quality premium cabin product to compete with the big 3, and likely something higher end than what Virgin offers now. Nothing like this exists in the Alaska fleet/vision.

The other path is to compete on price only, selling an inferior product at the front of the plane (and potentially throughout). I’m not sure that can be a model they “win” at. It’s unclear they can make enough money selling cheap seats between New York and California given those fares routinely drop to less than $300.

In the short-term, I would expect them to compete on cost, similar to how Virgin does now. That should continue to provide opportunities for folks to travel cheaply back and forth between the coasts.

The combination of Alaska and Virgin also presents the possibility of a competition with both United and Southwest, two carriers that operate a decent chunk of flights within the state of California. That could ultimately be a good thing for customers as well. Planes are mostly full, which could be the obstacle to an all-out price war. But, if any of these airlines decides to throw some capacity at these routes, it could be very good for customers.

Bottom Line

I’d like to say this is more complicated than Virgin customers mostly being ticked off their favorite brand went away and Alaska folks being happy for the expanded network. But, I think those are really the biggest key elements here. Folks who are fans of Alaska’s model will get many more chances to fly in the network and increase their chances of earning/retaining elite status with them. I’ll be curious to see how many of Virgin’s customers believed in “the brand” as opposed to the airline decide to jump ship. JetBlue is the only airline with a similar vibe, and that’s not really an option for many folks in California.

The post Alaska Air Acquisition of Virgin: What Can Customers Expect was published first on Pizza in Motion.