Barclaycard Arrival World MasterCard

In the past, I haven’t talked much about cards that earn cash back because there was always tons of value in earning and redeeming points that could be leveraged with the airlines for much better value. But, after United gutted their award chart recently, I started thinking about how I was going to make sure I was covered for travel in the future. Because this is a copy-cat industry, I expect that American will devalue their award chart in 2014. I don’t expect it to be as bad as United’s, but it’s likely to be more expensive than it is now.

Another consideration for me personally is credit card sign-up bonuses. I don’t go crazy with such things but the banks make it so profitable right now to sign up for new cards it’s hard to turn down. That being said, I’ve already received a lot of the big bonuses and I’m not interested in churning most of the secondary cards out there. I have a Chase Sapphire, Ink Bold, Ink Plus and Starwood AMEX, the Citi AA Executive card and a Barclay US Airways Mastercard.

With the exception of US Airways Mastercard, most folks will find that you can’t apply for these cards a second time and receive the sign-up bonus again. So, I’ve decided the Arrival card is my next card. I’ll explain why.

First, full disclosure, I do earn a referral credit if you apply through my link. But, I’ve had a referral link for this card for quite some time and just never felt it was compelling enough for me to apply for it. It’s certainly a good fit for specific folks, but I have enough trouble trying to write about all the stuff I’m really knowledgable about, so I don’t try to cover things I’m not an expert on. For example, you won’t see a lot of Delta news here because I don’t spend a lot of time contemplating their program, it’s just not a good value proposition for me.

Now that I’ve made the decision to apply for the card, I figured I would cover it for my readers.

1. This offer waives the $89 annual fee for the first year. When I’m deciding to try a new card, I prefer offers with no annual fee (who doesn’t?). I’m not sure if I’ll use this card in year 2 and beyond but a year should give me a better idea of my usage.

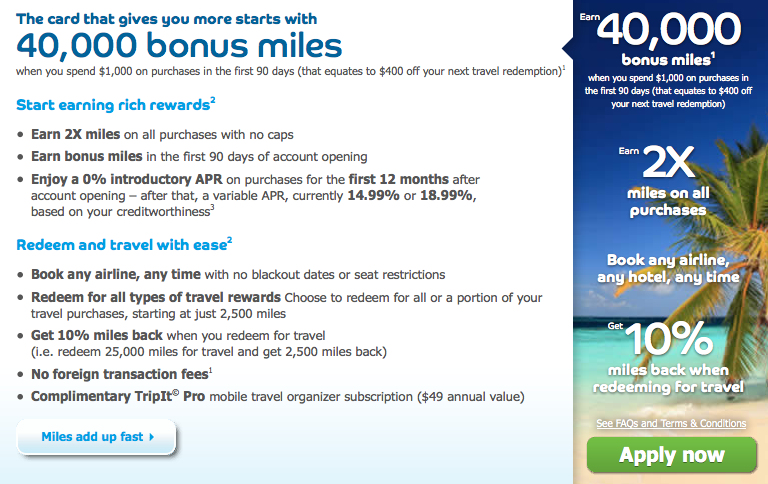

2. The card offers a 40,000 mile sign-up bonus for only $1,000 in spending over the first 90 days. Very achievable.

3. The 2X miles are essentially 2% cash back. That’s the same as the Fidelity card I currently recommend for folks looking for cash back cards.

4. If you’re redeeming those “miles” for travel, they rebate you 10%, meaning you’re effectively getting 2.2% cash back on travel purchases.

5. No foreign transaction fees. Most of my cards don’t have these now, but some still do. They add up quickly and I like to travel internationally.

Signing up for the card and hitting the $1,000 in required spending will net you $440 in free travel. That’s highly flexible in that you can spend it on any airline/hotel you want. I’ve got a few trips this year where I’m likely not to have a Hyatt or Starwood in one of the cities I want to travel to. Being able to get a room for free in those spots is very appealing.

I don’t use TripIt Pro, so that doesn’t add any value to the mix for me. But, if I were to start using it by the end of the year I feel like I could find it cheaper than the $49 retail price noted here. That being said, some may find value in that benefit.

Don’t get me wrong, I’m not sure I’ll want to keep this card for year #2. With an annual fee, I still think that I’ll want to earn miles or points with someone like American or United more than I would just get “cash back”. But there’s certainly a “low hanging fruit” mentality here. Some folks don’t like having to figure out the redemption part of the game. That’s why cash back is appealing to them. And, certainly, finding award tickets isn’t as easy as it used to be, though I did just find great availability for 4 tickets to Italy this summer.

2.2% cash back for travel beats the 2% straight cash back most card offer now, and certainly beats that horrible 1.5% cash back Quicksilver card from Capital One that Samuel Jackson is pimping. Loved you in The Negotiator and one of those Die Hard movies, Samuel. But the best cash back is elsewhere.

I had debated getting an American Express Platinum card instead. That has a $200 airline fee waiver and Membership Rewards points are flexible, similar to the Ultimate Rewards points the Chase Sapphire and Ink cards earn. But, it also carries a $450 fee and some of the benefits are not specifically a good fit for me. I already have Amazon Prime (which they offer for free) and the loss of the American Airlines club lounges weakens that benefit for me. AMEX is opening up more of their own branded lounges. That’s appealing to me but I likely won’t apply for this card until later in 2014 or 2015.

In summary, I’m mostly applying for the sign-up bonus. I’ll wait to see how far the shoe drops on any American Airlines changes and evaluate whether I want to pay the annual fee on this card a year from now.

As noted above, if you click on one of my referral links and apply for a card, I’ll receive a referral credit. If you do, I certainly appreciate it. Nobody put a gun to my head, least of all the merchant banks offering me referral credit. There are plenty of cards that will offer me a credit that I don’t bother writing about because I don’t think they offer a very good value.

Sounds good!

You wrote

With the exception of US Airways Mastercard, most folks will find that you can’t apply for these cards a second time and receive the sign-up bonus again.

I have a US Airways Mastercard..Does this mean I could get a second card under my business?

Shirley, not sure if you’re asking whether you can get another US Airways Mastercard or whether you can get an Arrival card. I know folks who have more than one US Airways Mastercard, but I think Barclay is only issuing ones now to folks who have closed their previous account. There is not a business version of the US Airways MC that I’m aware of.

So you are saying that if I have the US Airways Mastercard I cannot apply for this card? I know the US Airways card will obviously be going away soon. But I would have to close the US Airways Mastercard before I could open up an Arrival card and get the sign up bonus?

FFF, no. What I’m saying is that some folks who have a US Airways Mastercard NOW may not be able to apply for another US Airways Mastercard right now. You can have both the US Airways card and the Arrival card as long as Barclay approves you for both.