Citibank Making Sure We’re REALLY Covered with the Citi AA Executive Card

I applied for the Citi Executive Card a few months after it came out. Not all of the benefits applied to me, but there was enough there to warrant me applying. Shortly thereafter, Citi announced it would no longer be continuing the AA debit card relationship, so that meant my wife needed a backup card to her Starwood AMEX. I never got around to asking for a second card this weekend, until I looked at our bank statement and saw that my wife had a couple of medium-sized charges on the old AA debit card.

Now, spending money on a credit card that earns no reward in my household is akin to someone throwing out Yankees gear or dressing my son in Red Sox colors. But, in this case, it wasn’t my wife’s fault. I needed to get off my butt and contact Citibank. While on the phone, they were nice enough to expedite a card free of charge (duh, then we can charge more on the card sooner so they make more money).

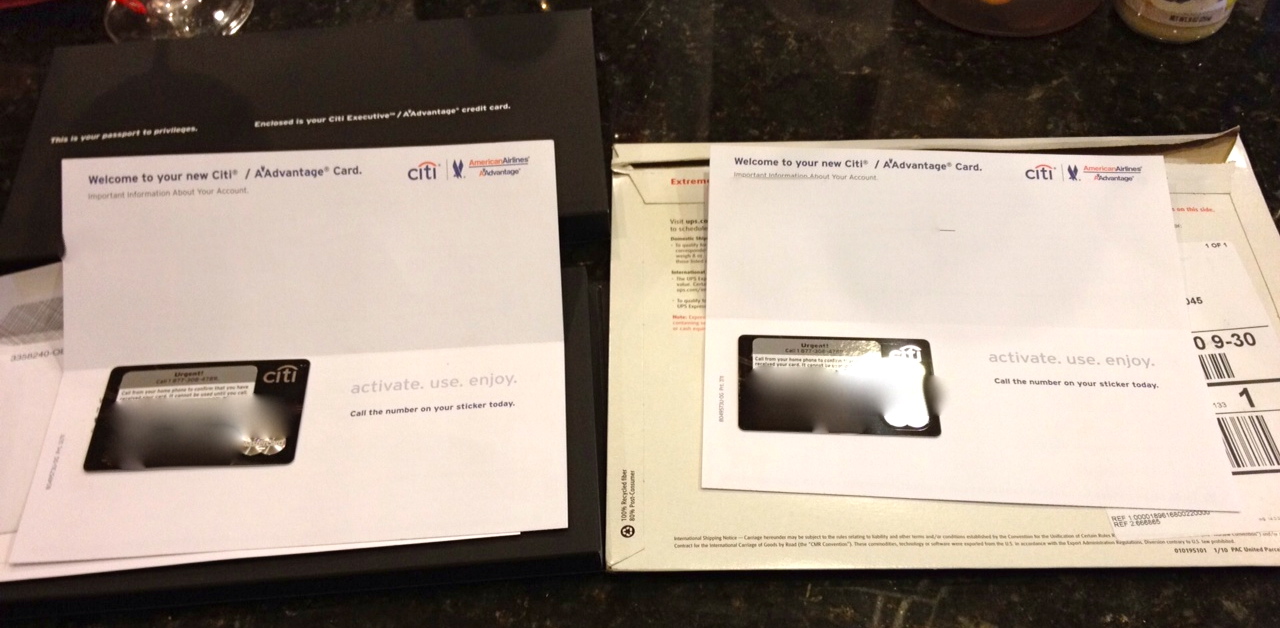

When I arrived home last night, I was a bit surprised to find a box on the front doorstep as opposed to just a standard envelope. When my AA Executive card came, it arrived in a high-end box. This card is being positioned as a high-end card (as evidenced by the $450 annual fee). And, while packaging doesn’t do much for me, I understand why they’re dressing it up. I did find it a bit surprising that they dressed up the second card for my wife, since I’d already received the dog and pony show:

And, while I certainly appreciate Citi impressing my wife with the full presentation, I doubt she needed TWO CARDS. But, lo and behold, I also received a smaller package with another card in just a regular UPS pouch:

Hey, it’s their dime. 🙂

You can read more about the AA Exec Card on Milepoint.com, where AA released the info early.

If you’re a casual flyer but travel with multiple people (i.e spouse and kids) and don’t have status, this card has a lot of advantages for $450 a year. Consider just the baggage allowance. It’s $25 for a checked bag, so you’d save $50 per round trip with a checked bag.

Another benefit of value are an Admirals Club membership. Membership is $500 a year if you don’t have any status with AA, so acquiring the card if you’re thinking about becoming an Admirals Club member is a solid idea. Even Executive Platinums pay $350 a year for Admirals Club, so there’s a ton of value here if you like having club privileges.

You also get priority check-in and boarding, which I don’t think I could fly without at this point. Because of bag fees, everyone wants to carry a bag onto the planes. With planes fuller than ever, there’s almost always a dozen or so people who end up having to check their bag at the gate.

You also earn double miles on all AA purchases.

But, the real reason I got the card is because it comes with the ONLY current way to earn Elite Qualifying Miles (EQMs) on AA without sitting your butt on a plane. Spend $40K on the card annually and you’ll receive 10K EQMs. For me, that means I only need 90,000 miles to maintain my Executive Platinum status. And, now that I’ve been Exec Plat for a few years, I’d never want to go back. They treat me like royalty, and much better than United treats me as a 1K for my 100,000 miles of business I give them a year.

If you don’t have a mileage or points-earning credit card, you need to catch up. This card isn’t the perfect fit for everyone. But, there is a bunch of value consider.